The Profit Margin: June 27, 2022

Statistic of the Week

There are currently twice as many job openings as there are unemployed workers in the US economy. For available jobs: 25% require a college degree, 39% don’t require a degree, and 36% have a variable requirement (meaning in some instances a degree is required, in others it is not). The number of jobs requiring degrees has been declining at the same time college enrollment has been falling off.

Global Perspective

Members of the G7 met in Germany to primarily discuss the war in Ukraine and its repercussions on energy and food markets along with the global economy. Among the first coordinated actions at the summit was to ban imports of Russian gold and further tighten sanctions in an attempt to limit Russian funding for the conflict.

Market Moving Events

Monday: Durable Goods Orders, Pending Home Sales

Tuesday: Consumer Sentiment

Wednesday: GDP(Revision)

Thursday: Jobless Claims, PCE Inflation, Income and Spending

Friday: ISM Manufacturing, Construction Spending

Commentary

Domestic equity markets put in a strong move to the upside as investors seemed to regain some confidence in the Federal Reserve’s ability to reign inflation in. (Being in a very oversold condition likely added fuel to last week’s rally). All three major averages finished in the black. The Nasdaq was the week’s leader, finishing up 7.49%.1 The S&P 500 jumped 6.45%.2 And the DJIA brought up the rear, gaining 5.39%.3 Fixed income yields moved way lower. The yield on the 10-year Treasury fell -0.11% to finish Friday at 3.13%.4

Fed Chair Powell testified before both houses of Congress over the course of the week. He reiterated that the Federal Reserve’s “commitment to tame inflation is ‘unconditional.’”5 In testimony, the Chairman noted that the consumer’s future inflation expectations are creeping up; this was a key factor in the decision to raise interest rates by 0.75% at the last FOMC meeting.6 Currently, the futures markets are placing a 100% probability in a 0.75% rate hike at the end of July.7

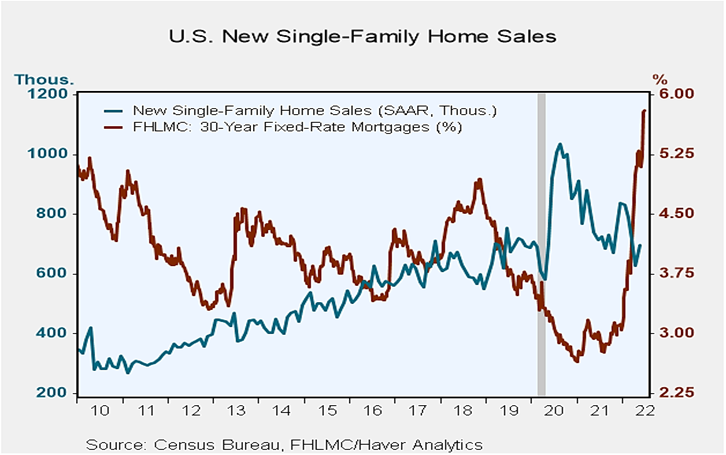

As we enter the summer months, all eyes will be on the behavior of the consumer as this will likely dictate whether the economy enters a recession. New home sales (chart right) were positive.8 Yet, car loan delinquencies have been rising while credit card balances surpassed pre-pandemic highs.9 Consumer sentiment hit a record low last month despite decent continued spending.10 Crosswinds remain.

Chart of the Week

Sources

Statistic of the Week:

Barron’s

Global Perspective:

The Economist

Market Moving Events:

MarketWatch.com

Chart of the Week:

Haver, Census Bureau

Commentary: 1.Bloomberg 2.Bloomberg 3.Bloomberg 4.Bloomberg 5. Investor’s Business Daily 6. Barron’s 7. Investor’s Business Daily 8.Haver Analytics, Census Bureau 9. Investor’s Business Daily 10. Investor’s Business Daily