The Profit Margin: June 24, 2024

Statistic of the Week

Mortgage rates eased again last week as the 30-year mortgage rate fell to the lowest levels since early April. The rate fell to 6.87% from 6.95% the week prior. One year ago, the 30-year mortgage rate was averaging 6.67%. This is the third consecutive weekly decline for mortgage rates. 15-year mortgages have also retreated.

Global Perspective

Champagne is in a bull market. Over the past five years, the “Champagne 50” index, which tracks the value of the top bubbly brands, has popped 47%. This is more than any other regional wine index across the globe. Global champagne sales hit records in 2021, 2022, and 2023 (after factoring in inflation). 2023 saw total global sales at $6.9 billion.

Market Moving Events

Tuesday: Consumer Confidence

Wednesday: New Home Sales

Thursday: Initial Jobless Claims, GDP Revision, Durable Goods Orders, Pending Home Sales

Friday: Personal Income and Spending, PCE Index, Consumer Sentiment

Commentary

Investors continued to push the broad equity markets higher last week, despite some signs that the U.S. economy is softening. The DJIA was the week’s leader, rallying 1.45%.1 The S&P 500, which has notched weekly gains in eight of the past nine weeks, rose 0.61%.2 And the Nasdaq finished the week unchanged.3 Yields fell slightly on the week. The 10-year Treasury finished Friday with a yield of 4.26%, down 0.03% from the week prior.4

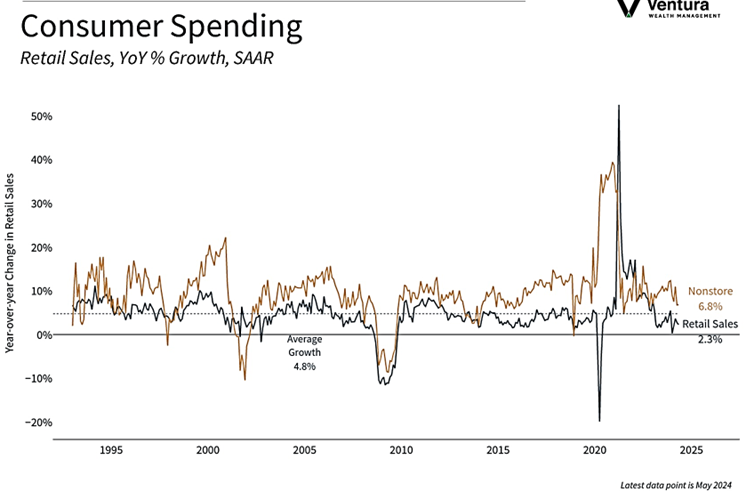

Initial jobless claims, retail sales, and home sales are all areas where we see the initial signs of economic slowdown. (Note: slowing economic expansion is not a recession). Jobless claims have been ticking higher in recent weeks yet remain below the critical level of 250,000 claims/week. Retail sales (chart right) are telling the story of a more economical consumer. And even though mortgage rates have been trending lower in recent weeks (see the Statistic of the Week), rates are higher than they were a year ago, posing a continuous challenge for homebuyers. These factors are likely to cause the FOMC to make their first rate cut in the current cycle. The market still believes this cut will come in 2024.

And… we will be hearing from members of the Federal Reserve en masse this week as public remarks are scheduled for multiple governors on multiple days. We will learn about the mindset of the consumer in both confidence and sentiment reports. Perhaps most importantly, we will receive the PCE inflation reading on Friday to close out the quarter. Markets are expecting a very tame reading.

Chart of the Week

The May retail sales report depicted consumers that may be in the process of tightening their belt. Retail sales ticked up 0.1% from the month prior and the April report was revised lower. Figures were below analyst expectations.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Census Bureau

Statistic of the Week:

Yahoo! Finance

Global Perspective:

The Economist

Commentary:

1.Bloomberg

2.Bloomberg, Investor’s Business Daily

3.Bloomberg

4.MarketWatch.com

5. Yahoo! Finance

6. Investor’s Business Daily