The Profit Margin: June 23, 2025

Statistic of the Week

Consumer Sentiment posted its first month-over-month rise in 2025 according to survey results from the University of Michigan. The result was the first positive move in the data series since December 2024 and surpassed analyst expectations. May’s reading was one of the lowest on record. Importantly, consumer inflation expectations came down. The one-year inflation expectation is now 5.1% from a four-decade high of 6.6% in May.

Global Perspective

The Federal Reserve was not the only major central bank making headlines last week. The Bank of England left its benchmark rate unchanged in their policy announcement. The rate stands at 4.25% as Britain’s inflation rate remains around 3.4%. Additionally, the Bank of Japan announced it would slow the pace of reductions in its bond purchase program as longer-term bond yields spiked in recent weeks.

Market Moving Events

Tuesday: Consumer Confidence

Wednesday: New Home Sales

Thursday: Jobless Claims, Durable Goods Orders, GDP Revision

Friday: Consumer Sentiment, Personal Income and Spending, PCE

Commentary

Last week, markets remained largely unchanged as investors monitored the FOMC’s decision, the possibility of a U.S. military strike on Iranian nuclear sites, and advancements in Congress regarding the One Big Beautiful Bill Act. Weekly returns across major domestic equity indices varied. The Nasdaq and DJIA posted gains, with returns of 0.21% and 0.02%, respectively.1 Meanwhile the S&P 500 experienced a decline for the second week in a row, dropping 0.15%.2 Fixed income yields saw a slight decrease, with the yield on the 10-year Treasury falling by 0.02% to close at 4.38% on Friday.3

The FOMC left the benchmark interest rate unchanged in their meeting announcement Wednesday. Not all Fed officials are on the same page in keeping rate cuts on “pause.” Several Fed officials, including Chair Powell, are scheduled to give public remarks. Their comments will likely be newsworthy as markets digest Fed policy against the backdrop of inflation and the conflict with Iran. The Fed’s preferred inflation gauge, the PCE Index will be released Friday and economists expect only a minor month-over-month change in both the regular and core readings.4

Investors will spend at least the first portion of the trading week fixated on the market’s reaction to the U.S. strikes on Iran’s nuclear facilities. At the time of writing, oil futures have jumped about 3% while equity future are down but subdued.5 In a year that has already been defined by market volatility (it ranks in the 89th percentile since 1990),6 the week ahead looks to be more of the same.

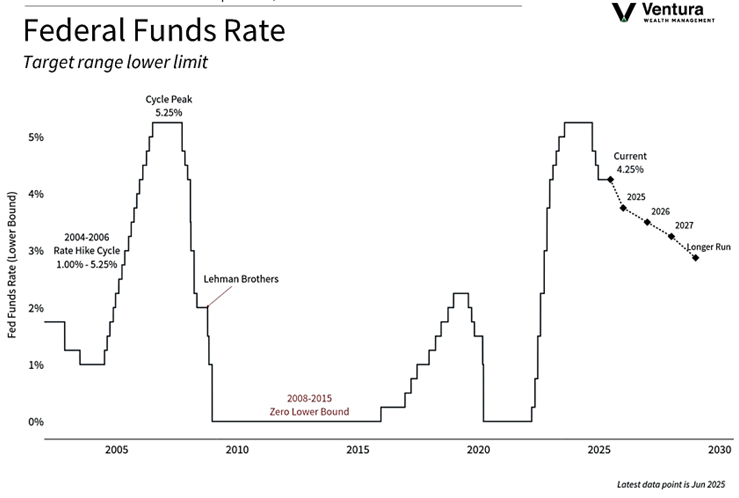

Chart of the Week

The FOMC left its benchmark interest rate unchanged last week. The current range is 4.25%-4.50%. The much-watched “dot plot” shows that Fed officials still expect to cut interest rates twice in 2025.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

The Federal Reserve

Statistic of the Week:

Yahoo! Finance

Global Perspective:

The Economist

Commentary:

1. Bloomberg

2. Bloomberg

3. MarketWatch.com

4. MarketWatch.com

5. CNBC.com, CME Group

6. Barron’s