The Profit Margin: June 21, 2022

Statistic of the Week

According to a recent study cited in The Economist, we spend large quantities of time in our lives doing repetitive tasks at work. Have you ever thought about how much time over the course of your life you will spend deleting emails, logging into systems, or correcting typos? Over a 45-year career, the average worker spends 180 days correcting typos, 145 days logging in, and six weeks deleting emails.

Global Perspective

The European Central Bank (ECB) held an emergency meeting last week as government bond yields rose across the currency bloc. Italian bonds were under the most pressure, rising to over 4%. The move came after the ECB had detailed a plan to end pandemic-related stimulus and begin to increase interest rates in July.

Market Moving Events

Monday: US Markets Closed

Tuesday: Existing Home Sales

Wednesday: Fed Chair Powell Testifying at Senate

Thursday: Jobless Claims, Fed Chair Powell Testifying at House Financial Services Committee Meeting

Friday: Consumer Sentiment, New Home Sales

Commentary

Irrespective of asset class, investors had a difficult time last week as the Federal Reserve raised the target Fed Funds rate by 0.75%. All three major US equity indices finished the week lower. The S&P 500 was the week’s worst performer, down -5.79%.1 The DJIA fell -4.79% and the Nasdaq retreated -4.78%.2 Having negative performance for ten of the past eleven weeks,3 both the S&P and Nasdaq remain in bear market territory.4 Adding to investor angst, the S&P had its worst weekly performance since the onset of the pandemic in March of 2020.5

Fixed income markets were extremely volatile. Yields initially rose on well-substantiated rumors that the Fed would raise rates by 0.75% instead of 0.50%. They reversed course on concerns that the Fed’s interest rate policies may cause a recession. (Weaker-than-expected retail sales and housing figures did not help soothe matters).6 Importantly, the futures markets currently reflect an 89% probability of another 0.75% rate hike in the July meeting.7 The 10-year Treasury finished the week with a yield of 3.24%, up 0.08% from the week prior.8

Several Fed governors are due to speak this week. Notably, Chair Powell will be testifying at committee hearings in both the House and Senate.9 Investors will be parsing every word as investors grapple with determining whether an economic “soft landing” is still possible, or recession has become inevitable.

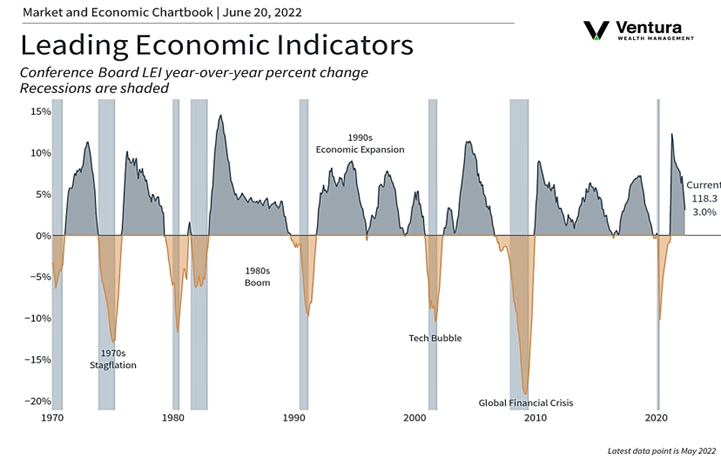

Chart of the Week

Sources

Statistic of the Week:

The Economist

Global Perspective:

The Economist

Market Moving Events:

MarketWatch.com

Chart of the Week:

Haver, Clearnomics, The Conference Board

Commentary: 1.Bloomberg 2.Bloomberg 3. Barron’s 4.Bloomberg 5. Barron’s 6. Investor’s Business Daily 7. Barron’s 8.Bloomberg 9.Marketwatch.com