The Profit Margin: June 2, 2025

Statistic of the Week

The dynamics of the housing market may be showing the early signs of a shift. Since 2013, the number of buyers has consistently exceeded that of sellers in the residential property market. According to a report from Redfin, a real estate firm, there were 500,000 more sellers than buyers in April. Despite this, home prices have persisted in their upward trend. The median sale price for existing homes reached $414,000 that month, reflecting a 1.8% increase compared to the previous year.

Global Perspective

For the first time since 1991, Japan has lost its title as the world’s largest holder of foreign assets, despite its holdings reaching a record high. Germany has surpassed Japan, holding just below $4 trillion, while Japan’s foreign assets amount to approximately $3.7 trillion. China ranks third with about $3.6 trillion in foreign assets. The strength of the euro against the yen contributed to this outcome.

Market Moving Events

Tuesday: Factory Orders, Job Openings

Wednesday: ISM Services, Beige Book, ADP Employment

Thursday: Jobless Claims, Trade Deficit, Productivity

Friday: Nonfarm Payrolls Report, Consumer Credit

Commentary

Last weekend’s news that President Trump was postponing an increase in tariffs on European goods, along with two rulings from the Court of International Trade finding that most of the tariffs announced by the administration exceeded the powers granted under the Emergency Economic Powers Act contributed to a recovery in the stock market last week. All three major indices posted gains. The S&P 500 flipped to positive performance on a year-to-date basis by rallying 1.80%,1 while the Nasdaq concluded its strongest month since November 20232 with a 2.05% increase.3 The DJIA brought up the rear; it climbed 1.60%.4 Bond yields decreased during the week, with the yield on the 10-year Treasury falling by 0.11% to close Friday at 4.41%.5

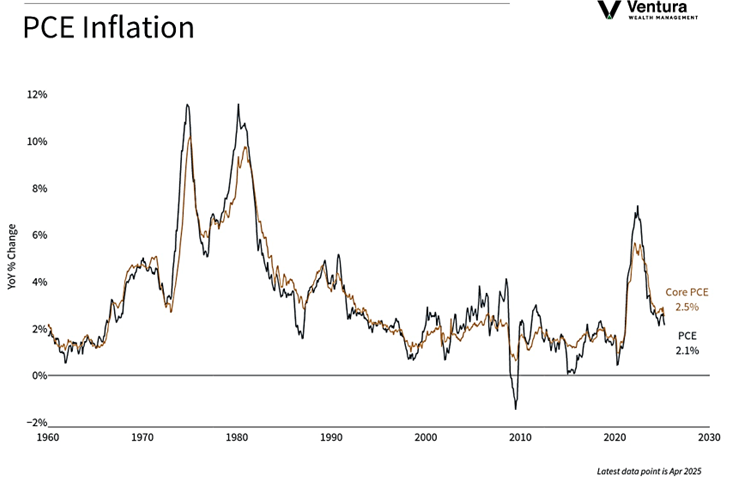

The PCE Inflation Index (chart right) report came in with no surprises. This was the last major inflation reading of a pre-tariff economy and registered at the lowest levels since the pandemic. Analysts will be watching the coming months’ inflation data carefully. It is not a question as to whether the tariffs will cause an uptick in inflation, the question is, “to what extent?” Over this weekend, President Trump said he planned to increase the tariffs on both steel and aluminum to 50%,6 to which the EU said it was “prepared to impose countermeasures.”7 The trade wars are not over.

The week ahead is heavy with economic data releases. Friday’s nonfarm payrolls reports will likely be the most critical as we learn how the labor market is performing against a very uncertain backdrop.

Chart of the Week

The PCE report, regarded as the Fed’s “preferred” measure of inflation, indicated a moderation in inflation levels for April. These results aligned with analysts’ expectations. The overall inflation rate decreased to 2.1%, while the core inflation figure fell to 2.5%. Both metrics remain above the target rate of 2.0%.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Economic Analysis

Statistic of the Week:

CNN.com, Redfin

Global Perspective:

The Economist

Commentary:

1. Bloomberg

2. Investor’s Business Daily

3. Bloomberg

4. Bloomberg

5. MarketWatch.com

6. MarketWatch.com

7. CNBC.com