The Profit Margin: June 19, 2023

Statistic of the Week

A new survey on Americans and money provides insight on what it means to be “wealthy” in the U.S. The piece found that an average net worth of $2.2 million was considered “wealthy” by respondents when classifying other people. When discussing themselves, that figure dropped substantially. (48% of respondents with an average net worth of $560,000 said that they already feel wealthy). The “wealthy” definition also expanded beyond finances. Overall wellbeing was cited by many respondents.

Global Perspective

As a result of foreign sanctions and the ongoing war in Ukraine, Russia’s finances are in shaky condition. The Kremlin will levy a tax on its oligarchs to try to refill its coffers. The new tax targets groups with profits in excess of $11.9 million to pay a one-time, 10% tax on its gains. This move is expected to generate about $3.6 billion. Russia has run up its deficit $42 billion so far in 2023.

Market Moving Events

Monday: US Markets Closed

Thursday: Jobless Claims, Existing Home Sales, Fed Chair Powell Senate Hearing, Leading Economic Indicators

Friday: S&P Flash Services PMI, S&P Flash Manufacturing PMI

Commentary

Domestic equity markets continued their rally last week, as all three major averages finished the week in positive territory. The Nasdaq, now having rallied for eight consecutive weeks, increased 3.25%.1 The DJIA rose 1.25%.2 And the S&P 500 notched a gain of 2.58% on a weekly basis.3

The Federal Reserve transitioned from a “dovish pause” to a “hawkish hold” over the past two meetings. The FOMC decided not to increase rates in last week’s meeting, matching market expectations. Commentary from the Fed Chair, along with guidance from the committee, indicated that the Fed was not done raising rates during this cycle. We believe, however, that the committee will largely be data dependent and that their course of action over the coming meetings is far from being written in stone. The hawkish tone did help push interest rates higher. The yield on the 10-year Treasury finished Friday at 3.77%, up 0.03% from the week prior.4

The week ahead is light on economic data. Fed Chair Powell will be testifying before the Senate. His comments will be closely followed. Beyond that, the major economic indicator that market participants will be watching is the Conference Board’s Index of Leading Economic Indicators. It has been flashing warning signs for months – a positive change would be welcome news.

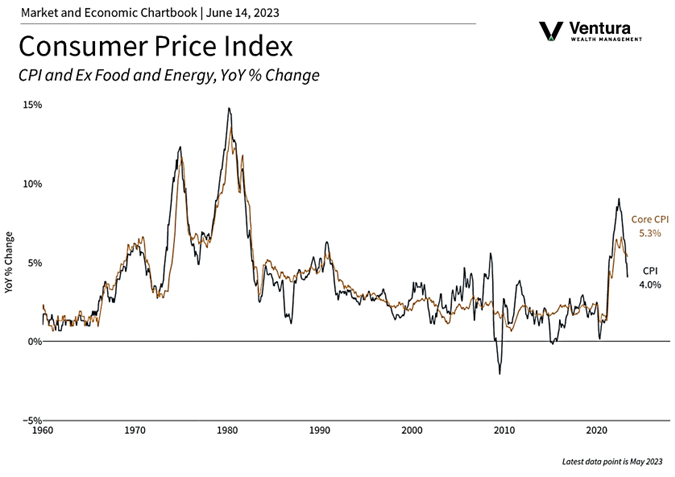

Chart of the Week

The Consumer Price Index (CPI) rose at an annual rate of 4.00%, registering the lowest reading in about two years. In the month of May, the index increased 0.1%, in line with estimates.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Bureau of Labor Statics, Reuter’s

Statistic of the Week:

Bloomberg Business / CNBC.com

Global Perspective:

The Financial Times

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg