The Profit Margin: June 17, 2024

Statistic of the Week

Mortgage rates are still high across the country. But, rates are higher in some states than they are in others. Vermont, Michigan, Delaware, and Oklahoma are the states with the four highest interest rates. California, Nevada, North Dakota, and Hawaii have the lowest interest rates. There is nearly a 0.40% spread between the most expensive and least expensive rate markets. There are many factors at play including the savviness of consumers, the competitiveness of lenders and regulatory differences.

Global Perspective

The International Energy Agency reported that while there is an expected slowdown in the growth of oil demand in the coming years, global production is expected to climb. Oversupply is expected to be 8 million barrels per day by 2030. The majority of excess supply is expected to come from the Americas – the U.S., Brazil, and Guyana.

Market Moving Events

Monday: Empire State Manufacturing

Tuesday: Retail Sales, Industrial Production

Wednesday: U.S. Markets Closed

Thursday: Initial Jobless Claims, Housing Starts

Friday: Existing Home Sales, Leading Economic Indicators

Commentary

Better-than-expected inflation data and a not-too-hawkish FOMC helped push domestic equity markets higher and bond yields lower last week. Two out of three of the major stock indices rallied. The tech-heavy Nasdaq was the week’s leader, jumping a notable 3.24%.1 The S&P 500 rose 1.58% (the S&P had four record closings over the course of the week).2 And, the DJIA disappointingly followed its lackluster year-to-date trend. It fell 0.54%.3 For those that pay attention to the Dow, it is lagging the S&P 500 by a little more than 10% so far in 2024. Market breadth is still narrow, and investors would like to see it broaden. 61% of the S&P’s year-to-date return can be attributed to NVIDIA, Microsoft, Meta, and Alphabet.4 The yield on the 10-year Treasury finished Friday at 4.23%, down 0.21% from the week prior.5

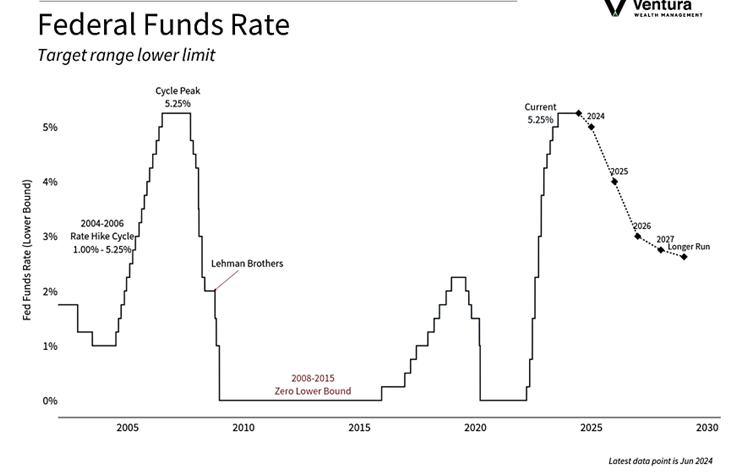

Both of last week’s major inflation reports, the Consumer Price Index (CPI) and Producer Price Index (PPI), were better than analyst forecasts. Investors met those news releases with optimism as they eventually pave the way for more dovish central bank policy. When Federal Reserve Chairman Powell took the stage at the post-meeting press conference, he summed up the rationale behind the position of current policy: “If we wait too long (to cut rates), that could come at the cost of economic activity, of employment, of the expansion. If we move too quickly, we could end up undoing a lot of the good we’ve done and have to then start over.”6 The FOMC is now forecasting only one interest rate cut in 2024, down from three the last time the forecast was released.7

Chart of the Week

The FOMC left interest rates unchanged at their June meeting. Target interest rates remain at 5.25%-5.50%. The committee currently projects only one interest rate cut in 2024.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

The Federal Reserve

Statistic of the Week:

MarketWatch.com

Global Perspective:

The Economist

Commentary:

1.Bloomberg

2.Bloomberg, Barron’s

3.Bloomberg

4. Barron’s

5.MarketWatch.com

6. Yahoo! Finance

7. Investor’s Business Daily