The Profit Margin: June 13, 2022

Statistic of the Week

Many investors in cryptocurrencies are having their first real experience with a bear market. Compounding their pain has been theft of their crypto coins. 46,000 individuals lost over $1 billion to theft since the start of 2021 according to the Federal Trade Commission. Losses to theft in 2021 were 60 times greater than those in 2018. The median loss to an induvial was $2,600.

Global Perspective

Guacamole is getting a lot more expensive. In Mexico, avocado prices surged by 19% during the month of May. The state of Michoacan, where most of Mexico’s avocado production is located, has an index which shows avocado prices up 140% in 2022. Price increases and scarcity of fertilizer is the main driver of the soaring prices.

Market Moving Events

Tuesday: NFIB Small Business Index, Producer Price Index

Wednesday: Retail Sales, Import Prices, Empire State Manufacturing, FOMC Meeting Statement and News Conference

Thursday: Jobless Claims, Housing Starts

Friday: Industrial Production, Leading Economic Indicators

Commentary

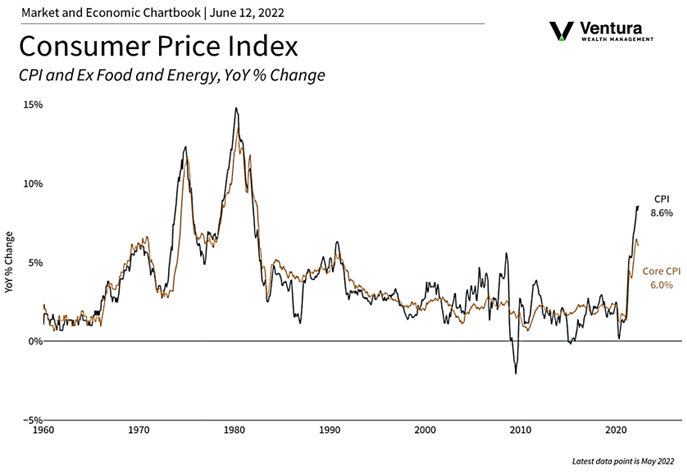

Domestic equity markets were in a sour mood last week before the May Consumer Price Index figure was released with a hotter-than-expected reading. From there, a temper tantrum ensued. All three major US equity indices finished firmly in the red with much of the week’s damage coming on Friday after the CPI report’s release. The Nasdaq was the week’s worst performer, down -5.60%.1 The S&P 500 fell -5.05%.2 And, the DJIA retreated -4.58%.3 Fixed income yields rose on news of the inflation data. The 10-year Treasury hit its highest levels since 20184 and finished Friday with a yield of 3.16%.5

There was much to digest in the CPI report, with few positives to take away. The chart right shows the headline figure climbing to a level not seen in over four decades. In the underlying data, nonenergy services rose 5.2% year-over-year, the quickest rate since June 1991.6 One notable positive was that non-food and energy inflation fell from a rate of 9.7% to 8.5%.7 However, we believe it is only a matter of time until food and energy prices begin to take a toll on the consumer. In short, the CPI data shows what many of us already know – inflation remains stubbornly high. Investors are concerned that the Fed will have to act more aggressively than forecast to bring it lower. Wednesday’s FOMC meeting announcement and Chair Powell’s press conference will likely be market moving events. Odds of a 0.75% rate hike have gone up considerably.

Chart of the Week

Sources

Statistic of the Week:

CNBC.com

Global Perspective:

Businessweek

Market Moving Events:

MarketWatch.com

Chart of the Week:

Haver, Clearnomics, Bureau of Labor Statistics

Commentary: 1.Bloomberg 2.Bloomberg 3.Bloomberg 4. Investor’s Business Daily 5.Bloomberg 6. Investor’s Business Daily 7. Investor’s Business Daily