The Profit Margin: June 12, 2023

Statistic of the Week

A new study examines the ages of billionaires across the globe. There are approximately 3,194 billionaires on the planet. Their median age is 67. 52% are over the age of 70. Less than 10% are under the age of 50. While many of the younger, tech-centric billionaires are capturing headlines, the vast majority of their peers are either at or nearing their retirement years.

Global Perspective

It is not just the United States where it is a “landlord’s market.” Since 2018, rents are up 21% in New York City. In London they have had a change of 24%. And strikingly, in Singapore, rents are up 65% over the same period. One major city bucking the trend: Hong Kong. There, rents are down about 6%.

Market Moving Events

Tuesday: CPI

Wednesday: PPI, FOMC Meeting Announcement, Fed Chair Press Conference

Thursday: Jobless Claims, Retail Sales, Import Prices, Industrial Production, Capacity Utilization

Friday: Consumer Sentiment

Commentary

Markets continued to march to an upbeat tempo last week as all three major U.S. equity averages finished the week in the black. The S&P 500, which has risen for four consecutive weeks,1 increased 0.39%.2 The DJIA rallied 0.34%.3 And the Nasdaq eked out a gain, rising 0.14%.4 The “bear market” we have been enduring since January 2022 ended last week from a technical perspective. It was the longest bear since 1948, lasting 248 days.5 Markets are still a good way off their all-time highs and any celebrations should be kept to a minimum as we still face a good deal of uncertainty. Importantly, there is still a lack of breadth to the market’s upswing. Only 51% of stocks in the S&P 500 are positive on a year-to-date basis.6

Yields ticked slightly higher last week as we approach the FOMC meeting announcement this Wednesday. The 10-year Treasury finished Friday with a yield of 3.74%, up 0.05% from the week prior.7 Market participants are expecting a “hawkish hold,” where the FOMC pauses at this month’s meeting, but indicates that it may continue to hike in the future.8 After ten consecutive meetings with rate hikes, there is less than a 30% chance of a hike at this meeting and about a 66% chance of a hike at the July meeting.9 Two economic releases this week are likely to influence the trajectory of rate hikes moving forward: the consumer price index (CPI) and producer price index (PPI). Any “surprises” in these readings may spook a happy, but leery, market.

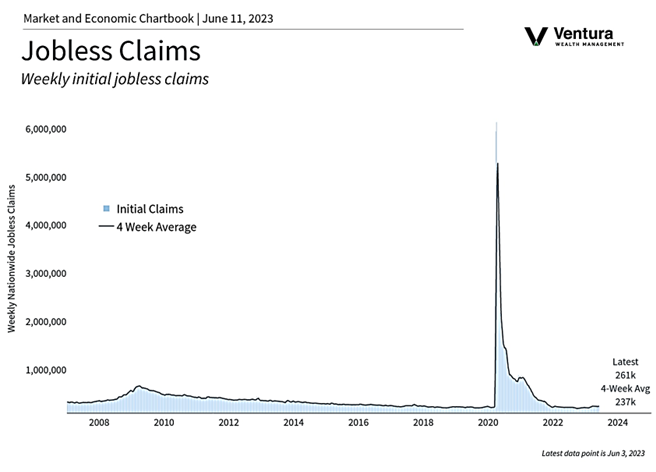

Chart of the Week

As another indicator that the labor market is slackening, initial jobless claims rose by 261,000 in the most recent reading. This was an uptick of 28,000 jobs and the highest level since October 2021. However, continuing claims declined by 37,000.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Bureau of Labor Statics, Reuter’s

Statistic of the Week:

CNBC.com

Global Perspective:

Bloomberg Business

Commentary:

1. Investor’s Business Daily

2.Bloomberg

3.Bloomberg

4.Bloomberg

5. Barron’s

6. Investor’s Business Daily

7.Bloomberg

8. Barron’s

9. Investor’s Business Daily