The Profit Margin: June 10, 2024

Statistic of the Week

The five most expensive cities to live in as a renter in descending order are New York City, San Francisco, San Jose, Westchester, and Boston. The income required to live comfortably in these cities in corresponding order is: $164,870, $125,545, $120,486, $117,804, and $117,517. The income level for “comfortable living” in these cities is approximately double the average American salary. (“Comfortably,” as defined by Moody’s, is needing only 30% of your gross income to cover housing costs).

Global Perspective

Guinness World Records recognized a new record for solving a Rubik’s Cube… by a robot. A Japanese robot was able to successfully complete the puzzle in 0.305 seconds, beating the previous robotic record by 0.075 seconds. (The robot beat the human record holder, Max Park, by a factor of greater than 10). Notably, the robotic record in 2009 was over a minute, underscoring how rapidly technology is advancing.

Market Moving Events

Wednesday: Consumer Price Index, FOMC Rate Decision, Fed Chair Powell Press Conference

Thursday: Jobless Claims, Producer Price Index

Friday: Import Prices, Consumer Sentiment

Commentary

The labor market does not want to quit, complicating matters for the Federal Reserve. A better-than-expected Nonfarm Payrolls report received a lukewarm reception from the markets on Friday. Yet, equity markets finished the week higher. All three major indices remain near all-time highs. The Nasdaq was the week’s leader, rallying 2.38%.1 The S&P 500 rose 1.32%.2 And, the DJIA logged a gain of 0.29%.3 Yields retreated slightly, although they remain relatively close to 30-year highs.4 The yield on the 10-year Treasury finished at 4.44%.5

There were two notable election results last week in countries benefiting from the post-pandemic movement of global supply chains. In Mexico, Claudia Sheinbaum was elected as the first female president. She is expected to continue many of her predecessor’s economic policies, while attempting to balance the budget.6 And in India, Prime Minister Modi’s party underperformed in elections, forcing a coalition government.7 This will cause some to question the viability of continued economic reform. Surprise results from the French elections, where the far right picked up significant ground, are moving the markets today.

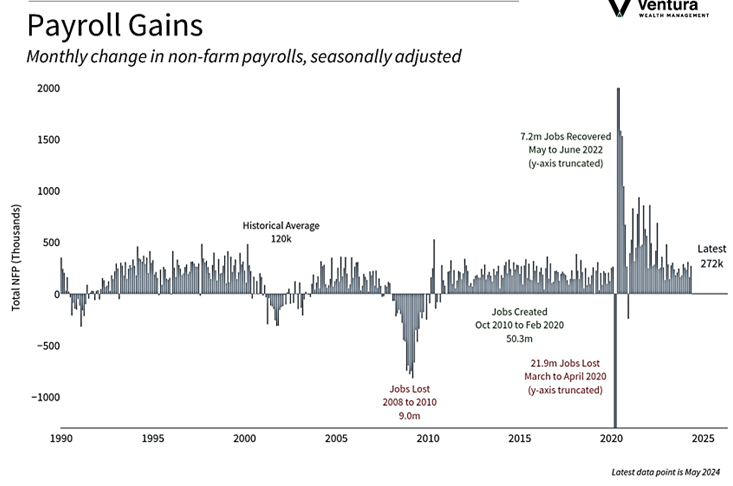

In the U.S, the Nonfarm Payrolls (chart right) took center stage. The unemployment rate ticked up to 4.0%.8 Wage growth also accelerated.9 This week, we will hear from the FOMC at the conclusion of their June meeting. We will also receive the CPI and PPI inflation readings. While there is not a lot of economic data being released this week, the data being released and FOMC announcements will be of consequence.

Chart of the Week

The Nonfarm Payrolls report for the month of May was stronger than expected. The U.S. economy added 272,000 jobs, far surpassing analyst estimates of 185,000. A strong employment market should correlate to a strong consumer base.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Labor Statistics, Reuter’s

Statistic of the Week:

CNBC.com, Moody’s Analytics

Global Perspective:

Mitsubishi Electric

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4. Investor’s Business Daily

5.MarketWatch.com

6. The Wall Street Journal

7. The Wall Street Journal

8. Investor’s Business Daily

9. Investor’s Business Daily