The Profit Margin: July 8, 2024

Statistic of the Week

Approximately 70.9 million people are believed to have traveled this past week for the Fourth of July according to AAA. That level would make the week the busiest Independence Day for travel ever. At the same time, not everyone is asking for time off. A recent survey found that over half of Gen Z and Millennial workers have “quiet vacationed,” or taken time off without formally requesting PTO.

Global Perspective

Masoud Pezeshkian, considered to be a reformer, was elected Iran’s next president. The new election was called after the previous president, Ebrahim Raisi, died in a helicopter crash earlier this year. Pezeshkian has been critical of Iran’s morality police and has called for “constructive negotiations” in an attempt to renew the 2015 nuclear deal.

Market Moving Events

Monday: Consumer Credit

Wednesday: Wholesale Inventories

Thursday: Jobless Claims, Consumer Price Index

Friday: Producer Price Index, Consumer Sentiment

Commentary

The bulls remained fully in charge during last week’s shortened trading. All three major averages rallied. The Nasdaq led the charge, jumping a notable 3.50%.1 The S&P 500 increased 1.95%.2 And the DJIA brought up the rear, climbing 0.66%.3 Bond prices rose on the week causing yields to decline. The 10-year Treasury finished Friday with a yield of 4.29%, down 0.12% from the week prior.4

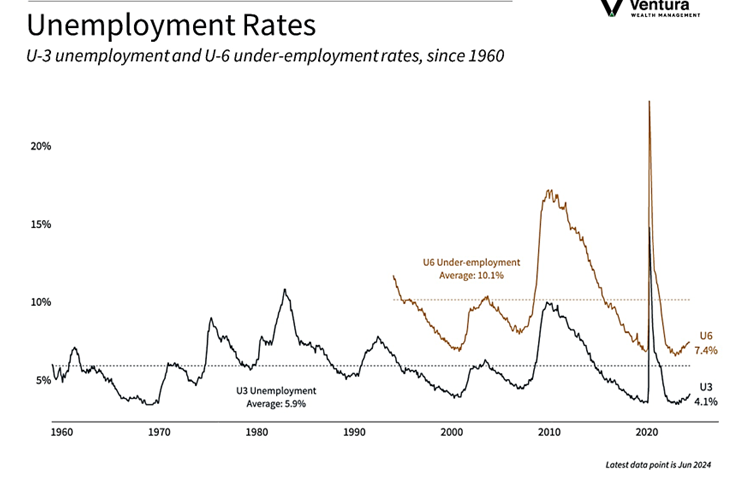

The “dual mandate” of the Federal Reserve is to “promote maximum employment and stable prices.”5 By no means is this an easy task. Some critics would say that the Fed “missed the ball” when inflation surged in 2022 (remember, this surge was caused by a pandemic-induced, never-before-seen supply chain shock followed by seemingly endless fiscal stimulus). But now that inflation has clearly cooled, the worry is that the Fed will remain stubbornly focused on inflation while the economy weakens beyond their goal of a “soft landing.” Last week’s Nonfarm Payrolls report showed the unemployment rate ticking up above 4% (chart right) and wage growth cooling to below 4%.6 While more jobs were added than expected, additions to the private sector rolls were lighter than analyst forecasts.7

Fed Chair Powell testifies before Congress this week, where he will likely face questions about policy moving forward – specifically the timeline of expected rate cuts amidst a slowing economy and cooling labor market. His testimony, plus CPI and PPI inflation readings will likely be the market’s focus this week until earnings season kicks off on Friday.

Chart of the Week

The U.S. economy added 206,000 jobs in June, however the U3 unemployment rate ticked up slightly from 4.0% to 4.1%. The rate ties the highest level of unemployment since October 2021.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Labor Statistics

Statistic of the Week:

CNBC.com

Global Perspective:

BBC.com

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.MarketWatch.com

5.The Federal Reserve System Board of Governors

6.Bureau of Labor Statistics

7. Investor’s Business Daily