The Profit Margin: July 5, 2022

Statistic of the Week

When market volatility increases, some retirement plan (401(k), TSP, 403(b)) investors will respond by stopping their automatic paycheck contributions. This common mistake hinders many retirement plans. When surveyed, the most common piece of advice (recommended by 70% of retirees) to their younger selves was to save and invest more. The survey covered 1,100 Americans aged 55 and older with at least $50,000 in financial assets.

Global Perspective

A recent theft of crypto currency is being blamed on the North Koreans. Approximately $100 million in crypto was stolen by hackers targeting Horizon, a platform / digital wallet. “Strong indications” point to the Lazarus Group (a North Korean state-sponsored hacking group) as the culprits according to research conducted by blockchain analysts.

Market Moving Events

Monday: US Markets Closed

Tuesday: Factory Orders

Wednesday: ISM Services, FOMC Meeting Minutes

Thursday: Jobless Claims, Foreign Trade Balance

Friday: Nonfarm Payrolls, Consumer Credit

Commentary

The first half of 2022 was rough for investors. For those keeping track in the equity markets, the major equity indices had their worst starts in decades: the DJIA since 1962, the S&P 500 since 1970, and both the Nasdaq and Russell 2000… ever…1 Last week closed out the quarter, and the weekly performance did not provide reprieve. The Nasdaq faired the worst, down -4.13%.2 The S&P 500 fell -2.21% while the DJIA retreated -1.28%.3

Fixed income yields fell on the week. The 10-year Treasury finished the week with a yield of 2.90%, down -0.23% from the week prior.4 While in previous weeks and months, a down-leg in yields would have likely triggered buying in equities, this week it did the exact opposite. The reason? Recession fears are growing, and some investors are shifting their allocations from equities to fixed income – causing yields to fall.

In the shortened week ahead, there are several key data releases. On Wednesday, the FOMC meeting minutes will be released. Investors will go through the minutes carefully to decipher if the Fed will continue its aggressive course of action. Friday’s nonfarm payrolls figure will provide insight into the state of the job market. With the unemployment rate around 3.6% and the economy adding about 400,000 jobs/month,5 we will be anxious to see if the Fed is achieving desired results of cooling things down. This may be a “bad news is good news” scenario.

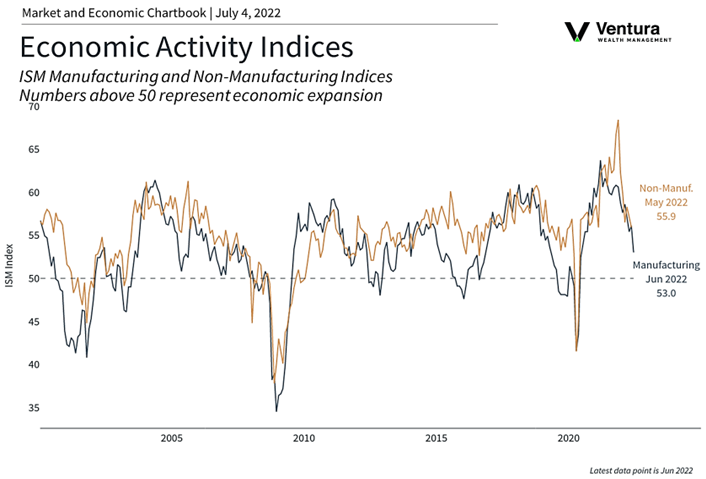

Chart of the Week

Sources

Statistic of the Week:

Barron’s

Global Perspective:

CNBC.com

Market Moving Events:

CNBC.com

Chart of the Week:

Haver, Clearnomics.com, Institute for Supply Management

Commentary: 1. Barron’s 2. Bloomberg 3.Bloomberg 4.Bloomberg 5. Investor’s Business Daily