The Profit Margin July 31, 2023

Statistic of the Week

A recent study found that 66% of married couples pooled all of their money and 21% pooled some assets, while 13% kept their finances completely separate. These figures were generally consistent across age groups. However, the study did find differences in the pooling of assets when evaluating factors like whether or not the couple had children and the gender makeup of the couple. Couples that cohabitated but were not married only completely pooled assets about 23% of the time.

Global Perspective

With bilateral trade totaling $263 billion in the first four months of 2023, Mexico has supplanted China as the largest trading partner for the U.S. Mexico had moved into second place in 2014, overtaking Canada. Tariffs introduced in 2018, the pandemic, and geopolitical tensions have weakened the U.S.-China trade relationship. Mexico-U.S. trade accounted for 15.4% of U.S. foreign trade.

Market Moving Events

Tuesday: ISM Manufacturing, Construction Spending

Wednesday: ADP Employment

Thursday: Jobless Claims, ISM Services, Factory Orders

Friday: Nonfarm Payrolls

Commentary

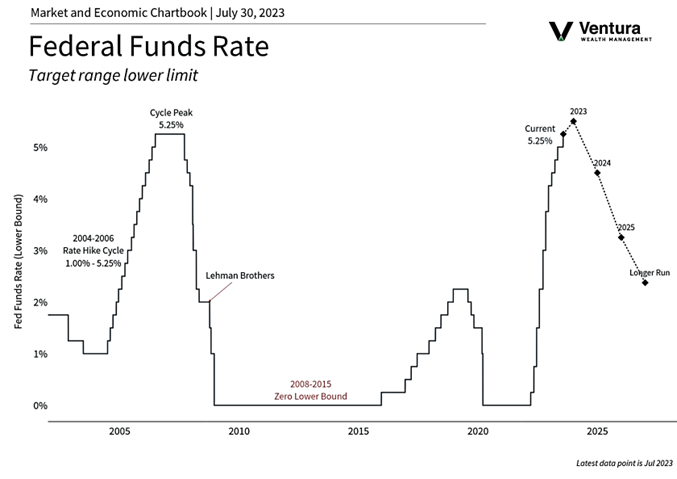

While we have entered the “summer doldrums” on the calendar, someone seems to have forgotten to tell the equity markets. All three major U.S. averages finished the week in the black. Over the course of the week, the DJIA ended a 13-day winning streak.1 However, it was still able to log a weekly gain of 0.66%.2 The S&P 500 rose 1.01%, and the Nasdaq, the year-to-date leader, rallied a strong 2.02%.3 Fixed income yields rose in a week where the FOMC continued their rate hike cycle (chart right). The 10-year Treasury finished Friday with a yield of 3.95%, up 0.11% from the week prior.4

Last week’s news cycle was dominated by earnings’ announcements and the FOMC announcement and press conference by Chair Powell. Market participants believe that there is a strong possibility that the FOMC has reached its terminal rate for this cycle – we will see. On the earnings front, companies continue to prove resilient. While earnings are up about 3% year-over-year5 (an “ok, not great” result), they have not plummeted as several notable market commentators predicted (loudly, on repeat, for about two years…). About half of the S&P 500 has reported with 80% of companies having beaten analyst estimates.6

This week we receive critical information on the state of the labor markets. Economists expect the unemployment rate to remain at 3.6% and wage growth to remain somewhat elevated (0.4% for the month).7 These readings could influence future decisions of the FOMC.

Chart of the Week

Raising the target by a quarter point, the new range for the Fed Funds Rate is 5.25% to 5.50%. This represents the highest level in 22 years. There remains debate as to whether or not the Fed is done raising rates this cycle.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, The Conference Board, Reuters

Statistic of the Week:

Harvard Business Review

Global Perspective: The Federal Reserve Bank of Dallas

Commentary:

1.Bloomberg, Investor’s Business Daily

2.Bloomberg

3.Bloomberg

4.Bloomberg

5. Investor’s Business Daily

6. Investor’s Business Daily