The Profit Margin July 29, 2024

Statistic of the Week

The first “modern” Olympic games were held in Athens in 1896. In those games, 241 athletes competed in 43 events. The Athens games in 1896 was only for male athletes; the first games to include female athletes was Paris in 1900 which had 22 female competitors. The 2024 Paris games are expected to have 10,714 athletes representing 206 nations. There will be 329 events in 32 different sports.

Global Perspective

Winning Olympians will receive different cash incentives based on the country they represent in the games. World Athletics, the governing body for track and field, will pay gold medal winners (in track and field events) $50,000 irrespective of their national affiliation. Relay teams will divide that prize. In the most recent summer games, Singapore paid out the most for a gold medal, approximately $737,000. U.S. gold medalists received $37,500.

Market Moving Events

Tuesday: Consumer Confidence

Wednesday: Pending Home Sales, FOMC Meeting Announcement, Federal Reserve Chair Powell Press Conference

Thursday: Jobless Claims, ISM Manufacturing

Friday: Nonfarm Payrolls, Factory Orders

Commentary

For the second straight week, volatility dominated the investment markets. And for the second straight week, the DJIA was able to log a positive return while both the S&P 500 and Nasdaq retreated. The Dow was able to gain 0.75%.1 Despite a strong rally on Friday, the S&P ended the week down 0.83% and the Nasdaq fell 2.08%.2 Fixed income yields fell. The 10-year Treasury dipped 0.04% to finish with a yield of 4.20%.3

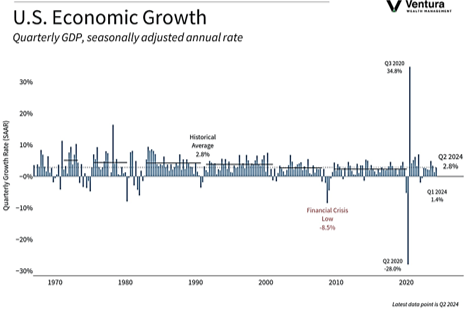

Last week was action-packed with earnings reports and economic releases. This week promises to be similar. The GDP report (chart right) for the second quarter showed the U.S. economy growing at an impressive rate. The consumer continues to power the economy. Notably, the personal savings rate continued to decline, from 3.8% in the first quarter down to 3.5% in the second quarter.4 Imports rose along with inventories. Imports had their biggest quarterly jump since the first quarter of 2022.5 The Fed’s preferred inflation gauge, the PCE price index, was also reported. The core reading was more-or-less in line with analyst expectations, rising 0.2% in June and 2.6% year over year.6

This week there will be an FOMC meeting announcement on Wednesday, followed by a press conference by Chair Powell. This will be closely followed by market participants. On top of several key earnings reports, we will receive the nonfarm payrolls report for July on Friday. The “fasten seatbelt” sign is on. Seasoned travelers know that the indicator light means that the ride has the potential to be bumpy – not that the plane is going down. Caution is warranted.

Chart of the Week

The U.S. economy grew at an annualized rate of 2.8% in the second quarter, faster than the 2.1% rate forecast by analysts. The figure was driven by strong consumer activity, a notable increase in inventories, and government spending.