The Profit Margin: July 28, 2025

Statistic of the Week

After the announcement of a trade deal framework between the U.S. and China, imports of rare-earth magnets to the U.S. increased by 660% in June. Chinese customs data indicates that the U.S. imported around 353 metric tons of rare-earth permanent magnets during this period.

Global Perspective

In its meeting announcement last week, the European Central Bank maintained its target interest rate. Headline inflation in the euro area stands at 2%, which is lower than the inflation rates observed in the United States, Japan, and the United Kingdom

Market Moving Events

Tuesday: Consumer Confidence, JOLTS, Trade Balance

Wednesday: GDP, ADP Employment, FOMC Meeting Announcement

Thursday: Jobless Claims, Personal Income and Spending, PCE Price Index

Friday: Nonfarm Payrolls, ISM Manufacturing, Construction Spending, Consumer Sentiment

Commentary

Last week, investor sentiment remained upbeat as the S&P 500 hit record highs in all five trading sessions.1 The Nasdaq finished Friday with its 15th record close of the year.2 And, the DJIA also ended the week in positive territory – it sits close to its all-time peak.3 Confidence was buoyed by the Trump administration’s announcement of a trade deal framework with Japan alongside strong corporate earnings. (We should note that there are concerns as to the stability of the framework agreement).4 Meanwhile, fixed income yields dipped slightly, with the 10-year Treasury yield closing Friday at 4.39%, down 0.03% from the week prior.5

Over the weekend, President Trump announced another framework for a trade deal, this time with the European Union. There are now frameworks for two of the “Big Three” (Canada/Mexico, China, and the E.U.) that are critical for U.S. trade. About 60% of total U.S. trade is conducted with these trading partners.6 Note: a framework is not a final treaty.

The week ahead is heavy with key earnings reports and economic data releases. On Wednesday, we will receive the second quarter GDP report which is expected to show that the U.S. economy expanded at a rate of about 2%.7 This is a reversal from the slight decline we experienced in the first quarter as companies raced against tariff deadlines and imported massive amounts of goods. Also on Wednesday is the FOMC’s interest rate decision. The Fed is expected to hold rates steady, however there is a strong possibility that two governors will dissent with the decision. If they do so, it will be the first time two governors dissented since 1993.8

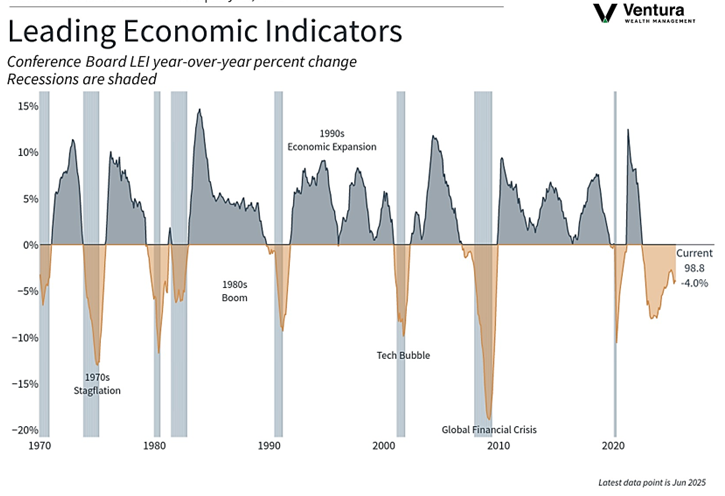

Chart of the Week

The Conference Board’s Index of Leading Economic Indicators fell more than expected in the month of June. The index is predicting a general slowdown (not a recession) in the economy in the second half of 2025.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week: Clearnomics,

Conference Board

Statistic of the Week:

CNBC.com

Global Perspective:

The Economist

Commentary:

1. Bloomberg

2. Investor’s Business Daily

3. Bloomberg

4. CNBC

5. MarketWatch.com

6. Wikipedia

7. Investor’s Business Daily / MarketWatch.com

8. Barron’s