The Profit Margin: July 25, 2022

Statistic of the Week

Gas prices in the US have been trending lower. Prices have now moved lower each week

for more than one month. The national average price last week was $4.49 per gallon,

having retreated from a peak of $5.01 per gallon. One year ago, the average price was

$3.19 per gallon. The decline will provide some welcome relief for many consumers.

Global Perspective

Ukraine and Russia have agreed to a pact that will allow Ukrainian grain exports through the

Black Sea. Three Black Sea ports Odesa, Chernomorsk , and Pivdennyi will be allowed

to release grain supplies into vital shipping lanes. The release of the stores will help steady

the shaky global food supply chain that has been impacted by the war.

Market Moving Events

Tuesday: Consumer Confidence, New Home Sales

Wednesday: Durable Goods Orders, FOMC Rate Announcement, FOMC Press Conference, Pending Home Sales

Thursday: GDP, Jobless Claims

Friday: PCE Inflation, Income and Spending, Consumer Sentiment

Commentary

Both stocks and bonds rallied last week as earnings season got under way in full. There were several notable misses, yet roughly 70% of companies beat analyst estimates.1 The laggard for the year, the beaten-down Nasdaq, was the week’s standout performer, rallying 3.33%.2 The S&P 500 rose 2.55%.3 And the DJIA brought up the rear, climbing 1.95%.4 Yields fell causing bond prices to rally. The yield on the 10-year Treasury fell -0.15% to finish Friday with a yield of 2.78%.5

The week ahead will not be for the faint of heart. It is packed with earnings reports, key economic releases, and a Federal Reserve announcement. While the market has gained steam and moved from the lows in recent weeks, these three elements will likely dictate the market’s next move. Half of the DJIA and one third of S&P 500 components will report their second quarter earnings.6 On the economic news front, we will gain insight into consumer confidence, income and spending, the state of the housing market, 2Q GDP, and inflation. And perhaps most importantly, the Federal Reserve will announce a rate increase on Wednesday coupled with a press conference by Chair Powell. While some analysts initially believed that the Fed may hike rates as much as 1.00% as a result of the hot June CPI reading, the recent softening in the economy has caused analysts to forecast a hike of either 0.50% or 0.75%.7 A 0.75% increase appears most likely.

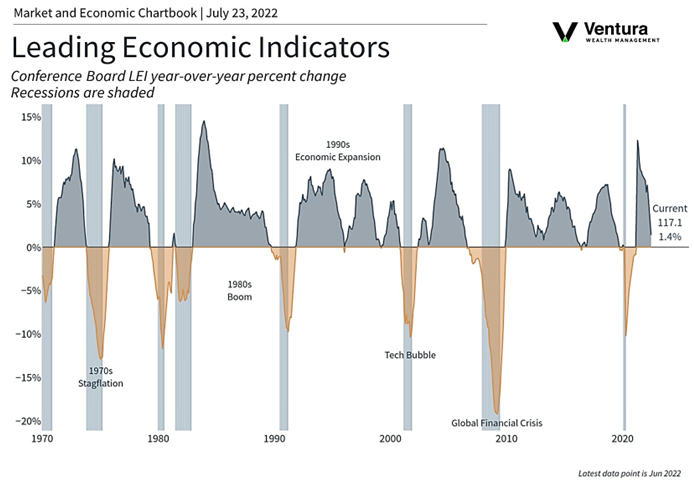

Chart of the Week

Sources

Statistic of the Week:

The New York Times

Global Perspective:

CNN.com, Bloomberg.com

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics.com, The Conference Board, Marketwatch.com

Commentary: 1.CNBC 2.Bloomberg 3.Bloomberg 4.Bloomberg 5.Bloomberg 6. Investor’s Business Daily 7. Barron’s