The Profit Margin July 24, 2023

Statistic of the Week

New changes are coming for Americans and 62 other countries who visit the European Union. The European Travel Information and Authorization System will have visitors apply for a visa-waver before arrival for a fee of $7. Those under 18 and over 70 will be exempt from the fee. Upon approval, the visa-waver will be valid for a three-year period.

Global Perspective

The release of slower-than-expected inflation data last week helped push the dollar lower relative to a basket of global currencies. Since its local peak in September, the dollar is down about 13%. While it is uncertain as to whether this trend will continue, the trend it is favorable to many emerging economies reliant on financing in foreign currencies.

Market Moving Events

Tuesday: Consumer Confidence

Wednesday: New Home Sales, FOMC Decision, Fed Chair Press Conference

Thursday: Jobless Claims, Durable Goods Orders, GDP, Pending Home Sales

Friday: Personal Income and Spending, PCE Index, Consumer Sentiment

Commentary

Despite it being a choppy week on Wall Street, the DJIA and S&P 500 were able to notch gains, while the Nasdaq registered a decline. The DJIA is on its longest winning streak since 2017 and was the week’s leader. It finished Friday with a weekly gain of 2.08%.1 The S&P 500 rose 0.68%.2 And the Nasdaq, this year’s leader of the major indices, fell 0.57%.3 Fixed income yields were predominately unchanged on the week. The yield on the 10-year Treasury rose 0.02% to finish Friday with a yield of 3.84%.4

The week ahead is busy and there are number of scheduled events (not to mention the unscheduled ones) that have the potential to move markets. Approximately one third of the DJIA will report earnings this week – this includes many notable components of the S&P 500 and Nasdaq as well.5 We are still very early in earnings’ season. Expectations have been high. Companies that have missed expectations have been punished.

On the economic front, both the consumer confidence and consumer sentiment readings will be released. A strong consumer is key to keeping the U.S. out of a recession. The FOMC is expected to raise interest rates on Wednesday to a target range of 5.25-5.50%, the highest level in 22 years.6 Fed Chair Powell’s press conference to follow the announcement will be scrutinized by market participants. A stance interpreted as “too hawkish” could rattle the markets.

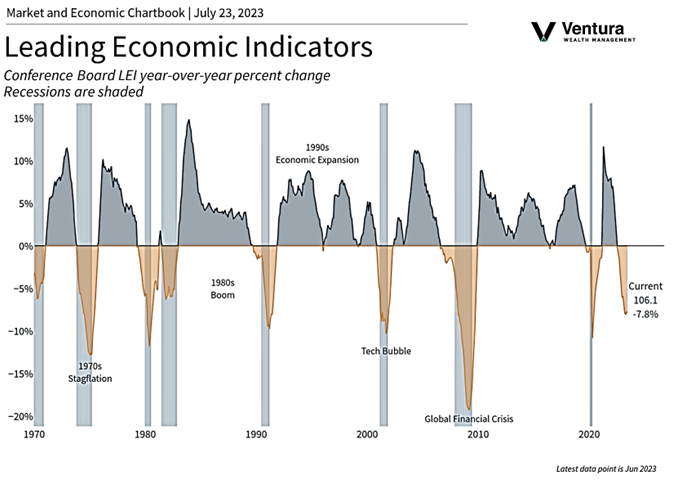

Chart of the Week

For the 15th consecutive month, the Conference Board’s Index of Leading Economic Indicators contracted. The decline of 0.7% was worse than economist expectations.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, The Conference Board, Reuters

Statistic of the Week:

Forbes.com

Global Perspective: The Economist

Commentary:

1.Bloomberg, Investor’s Business Daily

2.Bloomberg

3.Bloomberg

4.Bloomberg

5. Investor’s Business Daily

6. Investor’s Business Daily