The Profit Margin: July 22, 2024

Statistic of the Week

As we near election season in the U.S., there will certainly be talk of the “American Dream,” what it means, and how Americans conceptualize it. A recent poll centered on the American Dream found that more than 60% of Americans still believe in the Dream. Of those 65 and older, 66% responded in the affirmative. However, in the 18-29 age cohort, only 52% said they believed the American Dream was still possible. There is a strong belief that soaring education and housing costs are influencing the younger generation’s perspective.

Global Perspective

GDP in China grew at an annualized rate of 4.7% in the second quarter, down from a rate of 5.3% in the first quarter. The growth rate was the slowest recorded since early 2023, underscoring weak domestic demand, sluggish housing, and job insecurity. Luxury goods retailers are feeling the slowdown in the Chinese markets in particular, as consumers pull back.

Market Moving Events

Tuesday: Existing Home Sales

Wednesday: New Home Sales

Thursday: Jobless Claims, GDP, Durable Goods Orders

Friday: Personal Income and Spending, PCE, Consumer Sentiment

Commentary

It was a volatile week on Wall Street. And while the major averages were mixed, there was notable pain in certain sectors, particularly tech. The Nasdaq was the week’s worst performer, snapping a six-week winning streak.1 It fell 3.65% as the geopolitics of chips and a world-wide outage soured sentiment.2 The S&P 500 retreated 1.97%.3 Early in the week, the index hit an all-time high, only to end up having its worst week since April.4 And despite that, the DJIA was able to notch a gain of 0.72%.5 Fixed income yields ticked up slightly on the week. The yield on the 10-year Treasury finished Friday at 4.24%, up 0.06% from the week prior.6

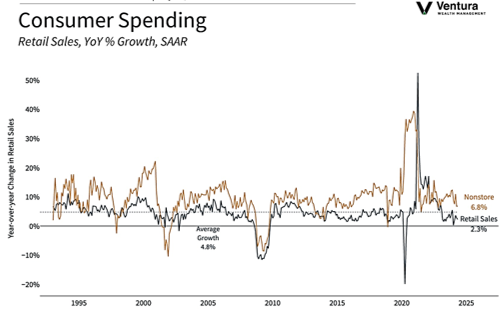

The week ahead has several key economic reports while earnings season continues in full, specifically for companies in the Dow. On Thursday, we will receive the second quarter’s GDP report. Analysts expect that the economy grew at a rate of 1.9%, an acceleration from the 1.4% growth rate we experienced in the first quarter.7 Retail sales (chart right) demonstrated resilience at the consumer level – that should translate into healthy GDP. Friday will be action-packed as personal income and spending, consumer sentiment, and the Federal Reserve’s preferred inflation gauge, the PCE Deflator, are all due to be released. Analysts are forecasting that inflation rose 0.1% in June and 2.5% year-over-year.8 Cooling inflation figures and a softening labor market are clearing the path for a September rate cut – currently forecast with a 95% probability.9 Those items, plus the news that President Biden is no longer running for reelection, are likely to keep investors busy this week.

Chart of the Week

Retail sales for the month of June came in above analyst expectations. Analysts were expecting a monthly decline of 0.3%; instead, sales were flat. Figures for the month of May were also revised higher.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Census Bureau

Statistic of the Week:

Investor’s Business Daily

Global Perspective:

The Economist

Commentary:

1. Investor’s Business Daily

2.Bloomberg

3.Bloomberg

4. Investor’s Business Daily

5.Bloomberg

6.MarketWatch.com

7.MarketWatch.com

8.MarketWatch.com

9. Barron’s