The Profit Margin: July 21, 2025

Statistic of the Week

In 2000, the median age of first-time homebuyers was 32. By 2024, this number had risen to 38, marking a multi-decade high. The National Association of Realtors also reports that the median age for both all buyers and repeat buyers has reached record highs.

Global Perspective

China’s GDP expanded at an annualized rate of 5.2% in the second quarter, surpassing analyst projections and improving upon the growth rate recorded in the first quarter. Despite this increase, the general consensus remains that the Chinese economy is experiencing a period of sluggishness.

Market Moving Events

Wednesday: Existing Home Sales

Thursday: Jobless Claims, New Home Sales

Friday: Durable Goods Orders

Commentary

Last week’s market activity was largely influenced by the start of the second-quarter earnings season. Although only about 10% of the S&P 500 companies have reported so far, 85% of them have exceeded expectations.1 Bank earnings were particularly strong, suggesting that despite ongoing volatility and trade war uncertainties, the economy remains relatively stable. Analysts initially projected a 4.9% year-over-year earnings growth for the quarter but have since revised their forecasts upward to 5.8%.2 The S&P 500 gained 0.59% over the week,3 while the Nasdaq reached a record high, increasing by 1.51%.4 The Dow Jones Industrial Average saw a slight decline, dropping 0.07%.5 Fixed income yields remained mostly steady, with the 10-year Treasury yield decreasing marginally by 0.01% to close at 4.42% on Friday.6

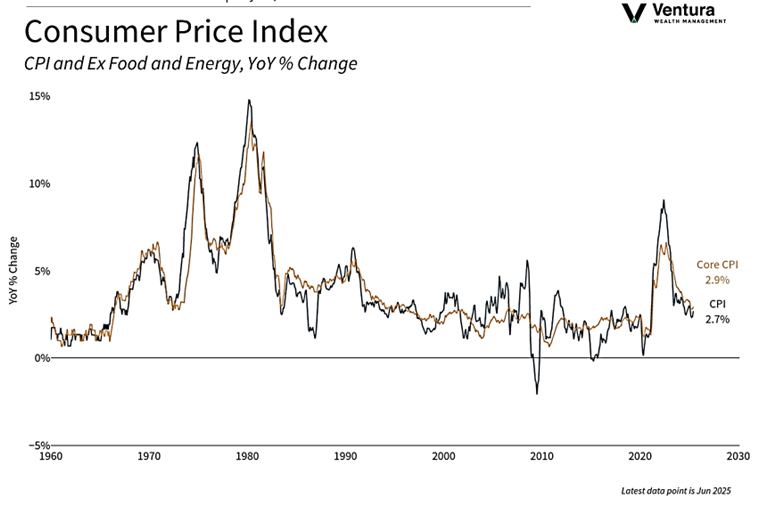

Several important economic data points were released last week. Inflation rose slightly, in line with analyst forecasts (chart right).7 Although some underlying components decreased, most economists agree that we are beginning to observe the early effects of tariff-related inflationary pressures. However, these tariffs have yet to significantly slow consumer spending. Retail sales exceeded expectations, and consumer confidence showed a modest improvement.8 Notably, the consumer confidence report indicated that year-over-year inflation expectations declined to 4.4%.9 While this figure remains concerning, it is less severe than analysts had anticipated. The upcoming week features a relatively light economic calendar, so attention will once again focus on earnings reports, with major technology companies leading the way.

Chart of the Week

Inflation, gauged by the Consumer Price Index, increased once more in June. The year-over-year headline rate stood at 2.7%, with the core measure at 2.9%. The report was in line with estimates. The June figures are starting to show the effects of the tariffs.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week: Clearnomics,

Bureau of Labor Statistics

Statistic of the Week:

National Association of Realtors

Global Perspective:

The Economist

Commentary:

1. MarketWatch.com

2. MarketWatch.com

3. Bloomberg

4. Bloomberg

5. Bloomberg

6. MarketWatch.com

7. CNBC.com, Bureau of Labor Statistics

8. Investor’s Business Daily

9. Investor’s Business Daily