The Profit Margin: July 18, 2022

Statistic of the Week

According to Vanguard, savings for retirement in plans (401(k), 403(b), etc.) stood near record highs across all measured age groups at the end of 2021. For those 65 and older, the average balance was just under $280,000. For the group between 45-54, balances were about $180,000. And for those just getting started in the 25-34 year cohort, the mean balance was just above $97,000. The average across all age groups was $141,542.

Global Perspective

Hotter-than-expected inflation readings across the globe have prompted central bankers to be more aggressive. In South Korea, central bankers raised the main interest rate by 0.50% to 2.25% – the biggest hike since 1999. Canada had a surprise increase of 1% to 2.50%. And in the UK, the leader of the Bank of England promised that the bank would do whatever is necessary to bring inflation down to its target rate of 2%.

Market Moving Events

Tuesday: Building Permits, Housing Starts

Wednesday: Existing Home Sales

Thursday: Jobless Claims, Leading Economic Indicators

Friday: S&P Global Manufacturing and Services PMI

Commentary

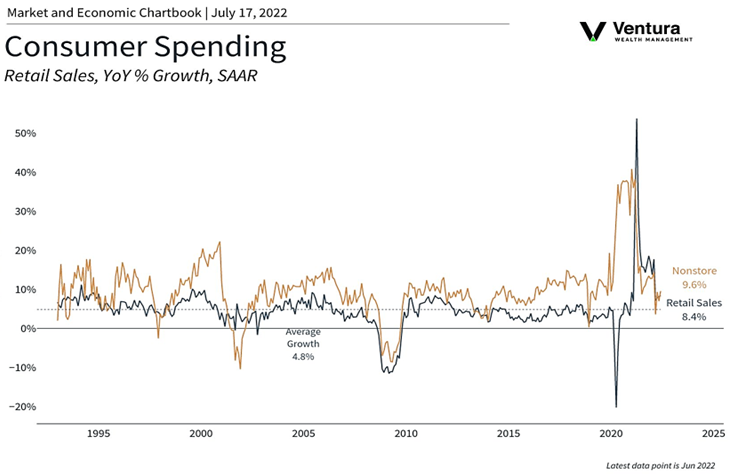

While the major equity averages ultimately finished in the red, markets showed considerable strength last week. All three major averages initially retreated on hotter-than-expected inflation data, only to turn higher on a few notable earnings reports and stronger-than-expected retail sales (chart right). The DJIA was the week’s best performer, dropping -0.16%.1 The S&P 500 fell -0.93%.2 And once again this year, the Nasdaq was the laggard, retreating -1.57%.3 Treasury yields fell on the week as investors focused their fears on a Fed induced recession over inflation. The 10-year Treasury finished Friday with a yield of 2.93%, down -0.17% from the week prior.4

June’s CPI reading of 9.1% was the highest reading in 40 years.5 While retail sales continue to show strength, high inflation in food and fuel prices have made approximately 47 million Americans financially insecure.6 We believe there is a good chance that “peak” inflation is in the rearview mirror; notably, gasoline prices are down about 10% since mid-June.7 The strength of the consumer coupled with declining energy prices (among other commodities) has decreased the likelihood of a 1% rate hike by the Fed next week to only 30%.8 A 0.75% hike is most likely.

The week ahead is relatively light on economic data but heavy on earnings reports. Expect volatility.

Chart of the Week

Sources

Statistic of the Week:

Fortune Magazine

Global Perspective:

The Economist

Market Moving Events:

MarketWatch.com

Chart of the Week:

Haver, Clearnomics.com, Institute for Supply Management

Commentary: 1.Bloomberg 2.Bloomberg 3.Bloomberg 4.Bloomberg 5. Investor’s Business Daily 6. Barron’s 7. Investor’s Business Daily 8. Investor’s Business Daily