The Profit Margin July 17, 2023

Statistic of the Week

There was a notable increase in the University of Michigan’s Consumer Sentiment reading for the month of June, as the measure hit its highest level in approximately two years. The index came in at a reading of 72.6, well above analyst expectations of 65.5 and a 13% month-over-month change. The monthly change was the fastest pace of increase since December 2005 – a period when the economy was recovering from Hurricane Katrina.

Global Perspective

India is the world’s fifth largest economy, trailing (in order) the US, China, Japan, and Germany. A recent report from Goldman Sachs predicts that India will grow to be the world’s second-largest economy by 2075. The report notes that labor force participation, which has been on a 15-year downward trend, is the most significant risk to the Indian economy.

Market Moving Events

day: Empire State Manufacturing

Tuesday: Retail Sales, Industrial Production

Wednesday: Housing Starts

Thursday: Jobless Claims, Existing Home Sales, Leading Economic Indicators

Commentary

More data points underscoring declining inflation coupled with a strong start to earnings’ season helped domestic equities and fixed income notch strong weekly performance. The Nasdaq returned 3.32% and remains the year’s performance leader among the major averages.1 The S&P 500 rallied 2.42% and the DJIA rose 2.29%.2 Both the S&P 500 and the Nasdaq finished the week at their highest levels in over a year.3 Yields dropped significantly on the week. The yield on the 10-year Treasury fell 0.23% to finish the week at 3.82%.4

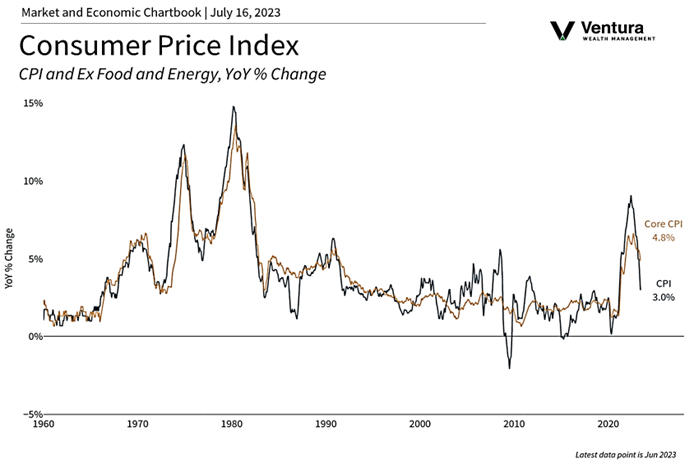

Both the Consumer Price Index (CPI, chart right) and the Producer Price Index (PPI) came in below analyst expectations for the month of June. The last time inflation dropped this quickly, as measured by the CPI, was May 1952.5 The results are not expected to influence the Federal Reserve’s next projected rate hike, which would come at the FOMC meeting on July 26th.6 The futures market did decrease the odds of a rate hike later in the year as a result of the data.7 However, core CPI at 4.8% and wage growth at a rate of 4.4% are complicating the Fed’s decision.8

Next Monday (July 24), the Nasdaq 100 will be going through a scheduled rebalance. This is happening because the six largest companies’ weightings have become too large relative to their counterparts. Rebalances like this have happened twice before, in 1998 and 2011.9 This may cause a slight uptick in volatility.

Chart of the Week

The Consumer Price Index reported inflation below analyst expectations last week, with a monthly change of 0.2% (0.3% expected) and a year-over-year rate of 3.0% (3.1% expected). This reading is about a third of what it was a year ago.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Bureau of Labor Statistics

Statistic of the Week:

Yahoo! Finance

Global Perspective:

CNBC.com, BusinessInsider.com

Commentary:

1.Bloomberg

2.Bloomberg

3. Investor’s Business Daily

4.Bloomberg

5. Barron’s

6. Investor’s Business Daily

7. Investor’s Business Daily

8. Barron’s

9. Investor’s Business Daily