The Profit Margin: July 15, 2024

Statistic of the Week

Taking a vacation this summer? While away, some of your fellow travelers may be incurring substantial debt as part of their summer plans. With credit card interest rates near record-highs, Americans are showing that they are willing to carry balances to pay for their vacations over time. According to a survey from WalletHub, 46% of people are still paying off their debts from last summer. The average rate in May of this year was 21.51%, up from 14.52% in May 2020.

Global Perspective

The size of America’s national debt is growing increasingly concerning. In June, the U.S. Treasury spent $140 billion in interest payments for public debt. This marked a 14% year-over-year increase. The U.S. national debt stands at just under $35 trillion. The size of the U.S. economy (GDP) is about $28.5 trillion.

Market Moving Events

Tuesday:Retail Sales, Import Prices

Wednesday:Housing Starts, Building Permits, Industrial Production, Beige Book

Thursday:Jobless Claims, Leading Economic Indicators

Commentary

Domestic equity markets continued their march higher last week with all three major indices finishing the week in positive territory. The DJIA, which is the year-to-date laggard by a significant margin, led the pack. It rallied 1.59%.1It also finished Friday at the 40,000 level on the button.2The S&P 500 rose 0.87%.3And the Nasdaq, which retreated on Thursday, recovered Friday and was able to finish the week with a gain of 0.25%.4The breadth of the rally appears to be broadening –this is healthy. Bond yields fell slightly on the week. The yield on the 10-year Treasury fell 0.10% to finish Friday at 4.19%.5

Last week’s economic reports centered on inflation data. The Consumer Price Index came in below expectations while the Producer Price Index came in above expectations. Core CPI rose only 0.06% for the month of June, the lowest monthly increase since January 2021.6There has been continuedspeculation about the health of consumers as they are feeling ongoing pain from inflationary pressures. So far, the consumer has not buckled. The retail sales report, due out Tuesday, is expected to show a minor monthly retreat of 0.1%.7 This figure will be monitored closely.

For clients that have had recent review meetings, we have commented that we believe that the most notable threats to the markets are political in both the domestic and geopolitical arenas. The assassination attempt of former President Trump this past weekend underscores this ongoing risk. We extend our deepest sympathies to the families of the victims and hope former President Trump has a speedy recovery.

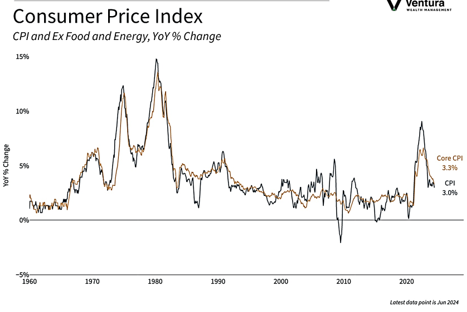

Chart of the Week

The Consumer Price Index (CPI) fell 0.1% in June, surprising economists expecting a rise in the key inflation measure. Year-over-year, the index rose 3.0%, also below estimates.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Labor Statistics

Statistic of the Week:

MarketWatch.com

Global Perspective:

CNBC.com, US Debt Clock

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg

5.MarketWatch.com

6. Investor’s Business Daily

7. Investor’s Business Daily