The Profit Margin: July 14, 2025

Statistic of the Week

The volatility triggered by the liberation day tariffs prompted investors to turn to safer assets in the second quarter. Among those withdrawing from riskier investments, 92% reduced their exposure to target-date funds. Conversely, investors allocating to new asset classes saw 41% add to bonds, 12% to money markets, and 11% to stable value funds. Notably, target-date funds are intended to be “buy and hold” investments, making this shift particularly concerning.

Global Perspective

It was a volatile week in the trade war. The Trump administration extended the deadline for trade agreements to August 1st but warned of higher potential tariff rates if negotiations fail. South Korea and Japan could be subject to 25% tariffs, Mexico and the EU might face 30%, and certain Canadian products could be hit with tariffs as high as 35%. A 50% tariff was threatened on imported copper.

Market Moving Events

Tuesday: CPI, Empire State Manufacturing

Wednesday: PPI, Beige Book

Thursday: Jobless Claims, Retail Sales, Import Prices

Friday: Housing Starts, Building Permits, Consumer Sentiment

Commentary

While last week was relatively quiet on the economic data front, it was very busy in the trade war sense. As the administration pushed back the July 9th deadline for many negotiations to August 1st, a new set of potential tariffs for key trading partners was issued. (See more in the “Global Perspective.”) For many of America’s trading relationships, President Trump said that the U.S would increase the blanket tariff rate, currently at 10%, to either 15% or 20%.1 Markets took the news in stride. While all three major U.S. averages finished the week in the red, the declines came after both the S&P 500 and the Nasdaq hit all-time highs on Thursday.2 The DJIA logged the worst weekly performance. It dipped 1.02%.3 The S&P 500 fell 0.31%.4 And the Nasdaq held up the best, retreating only 0.08%.5 Nvidia became the first company to attain a $4 trillion market cap on Thursday.6 Fixed income yields rose slightly on the week. The yield on the 10-year U.S. Treasury increased 0.06% to finish Friday at 4.41%.7

The week ahead is busy on several fronts. First, second quarter earnings kick off with Forty-two S&P 500 companies set to report.8 Second, both the Consumer Price Index and Producer Price Index reports will be released on Tuesday and Wednesday, respectively. Core CPI is expected to have risen 0.3% for the month of June and at a year-over-year rate of 3.0%.9 A “three handle” on this key inflation reading will not be greeted warmly by the Fed. Speaking of the Fed, numerous officials are slated to provide public remarks combined with the ever-changing trade war landscape, volatility is positioned to pick up in the days ahead.

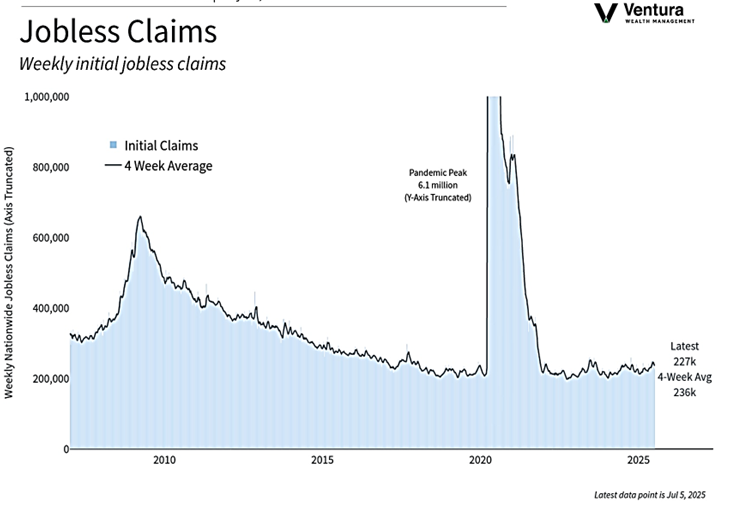

Chart of the Week

For the week ending July 5, initial jobless claims decreased slightly to 227,000. The four-week average remains at 236,000, staying under the important threshold of 250,000.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week: Clearnomics,

Bureau of Labor Statistics

Statistic of the Week:

Yahoo! Finance

Global Perspective:

The Economist, The Wall Street Journal, BBC.com, CNBC.com

Commentary:

1. Investor’s Business Daily

2. Investor’s Business Daily

3. Bloomberg

4. Bloomberg

5. Bloomberg

6. Barron’s

7. MarketWatch.com

8. MarketWatch.com

9. MarketWatch.com