The Profit Margin: July 10, 2023

Statistic of the Week

As the global population grows and ages, so too is the number of individuals expected to be suffering from dementia. By 2050, experts believe that the number of people with dementia will be triple current figures, totaling approximately 150 million. The developing world is expected to see the most amount of increase, with the biggest rise expected in North Africa, sub-Saharan Africa, and the Middle East.

Global Perspective

We have discussed “quiet quitting” as a national problem, but a recent study by Gallup points to the phenomenon being a global issue. The study estimates that low employee engagement could total $8.8 trillion annually, about 10% of global GDP. One positive note for employers: the percentage of “quiet quitters” of the workforce has dropped by about 2% since 2020, and the percentage of employees “thriving” is the highest in the past decade.

Market Moving Events

Monday: Wholesale Inventories, Consumer Credit

Wednesday: Consumer Price Index, Beige Book

Thursday: Jobless Claims, Producer Price Index, Federal Budget

Friday: Consumer Sentiment, Import Prices

Chart of the Week

Commentary

Domestic equity markets started the third quarter by retreating in a shortened holiday week. All three major averages finished the week in the red, despite strong economic data releases. The Nasdaq was the week’s best performer, dropping 0.92%.1 The S&P 500 fell 1.16%.2 And the DJIA, the least diversified of the major averages, suffered the worst, down 1.96%.3 The volatility in stocks was minor compared to the significant jump in fixed income yields. The 10-year Treasury yield moved 0.23% higher on the week to finish Friday at 4.05%.4 (Remember, higher bond yields mean lower bond prices).

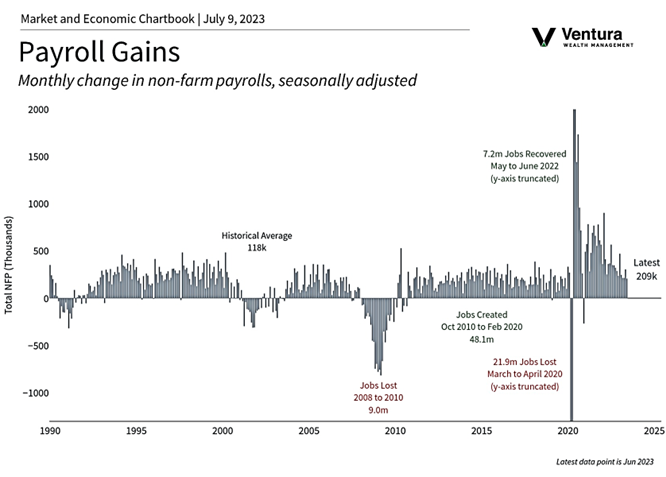

Speculation that the Federal Reserve was going to reaccelerate its rate hike agenda is what soured investors on stocks and caused bond investors to demand more yield. The next FOMC meeting announcement is on July 26th and market participants are expecting a 0.25% hike. This week we will receive both the Consumer Price Index (CPI) and Producer Price Index (PPI) readings for the month of June.5 They will certainly influence the Fed’s course of action. Core CPI, a key inflation metric, is expected to fall from a rate of 5.3% to 5.0%.6 Inflation is still heading in the right direction – just not fast enough for the Fed. (Last week’s Nonfarm Payrolls report, chart right, underscored that point as hourly wages rose 0.4% for the month).7 Beyond these inflation readings, earnings’ season for the second quarter will officially kick off on Friday. It is a busy week.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Bureau of Labor Statistics

Statistic of the Week:

HealthData.org

Global Perspective:

The Financial Times

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg

5.MarketWatch.com

6. Investor’s Business Daily

7. Investor’s Business Daily