The Profit Margin: July 1, 2024

Statistic of the Week

With the Fourth of July celebrations this week, fireworks, flags, hot dogs, and beer will undoubtedly be a part of many festivities. In 2023, the U.S. imported approximately $396 million of fireworks and $6.5 million of American flags. (The U.S. exported about $1 million of American flags to the rest of the world). And on the hot dog front … about 150 million will be consumed on July 4TH along with an estimated $4 billion in beer and wine.

Global Perspective

Deadly protests in Kenya sprung up after a controversial tax hike bill was introduced. At least 22 people were killed and the nation’s parliament building was set on fire. As a result of the protests and deaths, President William Ruto said he will withdraw the bill. Protestors believed that the bill would be overly burdensome for individuals and businesses already suffering under a high cost of living.

Market Moving Events

Monday: ISM Manufacturing

Tuesday: Job Openings

Wednesday: Initial Jobless Claims, ISM Services, Factory Orders, FOMC Meeting Minutes, Markets Close at 1PM

Thursday: U.S. Markets Closed

Friday: Nonfarm Payrolls

Commentary

A relatively light week for economic data and earnings releases kept market action tame. Domestic market performance was mixed. The DJIA and S&P 500 both retreated 0.08%.1 (The slight fall in the S&P does not negate a very strong start to the year). The Nasdaq notched its fourth consecutive weekly gain,2 eking out a gain of 0.24%.3 Fixed income yields rose on the week. The 10-year Treasury finished Friday with a yield of 4.40%, up 0.15% from the week prior.4

For those worried about election year stock market performance, a reassuring statistic was recently released. In presidential election years since World War II, there has not been a negative annual return in the S&P 500 when the month of January had a positive return. (This year’s January did indeed have a positive return). The average return during those years was 15.6%.5 Past performance is no guarantee of future results. Yet, the macroeconomic environment appears to continue to favor both economic expansion and a relatively healthy earnings environment – critical components for a rising market.

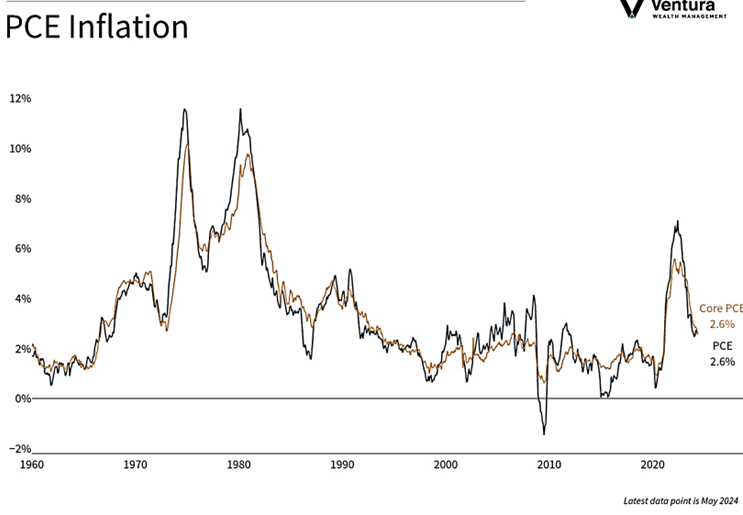

Last week’s release of the Fed’s preferred inflation measure, the core PCE Inflation Index (chart right) showed inflation’s continuing decent. Several FOMC officials, including Chair Powell, will be making public comments this week as they journey to different nations across the globe. Their comments, along with this week’s release of the FOMC Meeting Minutes and Nonfarm Payrolls Report have the ability to move markets in trading which is likely to be lighter because of the July 4th holiday.

Chart of the Week

The PCE Inflation Index showed inflation continuing to cool during May. For the month, core prices rose 0.1%. Year-over-year, core prices have risen 2.6%.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Economic Analysis

Statistic of the Week:

The Census Bureau, WalletHub

Global Perspective:

The Economist

Commentary:

1.Bloomberg

2. Investor’s Business Daily

3.Bloomberg

4.MarketWatch.com

5. Investor’s Business Daily