The Profit Margin: January 8, 2024

Statistic of the Week

The 2022 Survey of Consumer Finances was released and provided key insights into average and median net worth by age range in the U.S. The highest average net worth was for individuals between 65 and 69, at $1,836,884. The median net worth for that same group, however, was $394,300. The lowest average net worth was for the age cohort of 25-29, standing at $120,185. The lowest median net worth was for the 20-24 age group, $10,800.

Global Perspective

The Chinese government no longer wants Tibet to be referred to as “Tibet.” Instead, Chinese officials are pushing for the name “Xizang.” This is the name that China’s Han majority uses for the Tibetan homeland. The move comes as China tries to assimilate ethnic minorities in the country. Importantly, China is gearing up to be involved in the selection of the next Dalai Lama – Tibet, and this process, could become a geopolitical issue.

Market Moving Events

Monday: Consumer Credit

Wednesday: Wholesale Inventories

Thursday: Jobless Claims, CPI

Friday: PPI

Commentary

Coming off a very strong run to finish out 2023, domestic equity markets pulled back to start 2024. All three major averages finished the week in the red. The DJIA held up the best, dipping 0.59%.1 The S&P 500 retreated 1.52%.2 And the Nasdaq, which logged substantial gains over the last two months, fell 3.25%,3 weighed down by poor performance from Apple following two negative analyst revisions. As equities lost ground, yields rose in the fixed income markets. The yield on the 10-year Treasury jumped 16 basis points to finish Friday at 4.05%.4

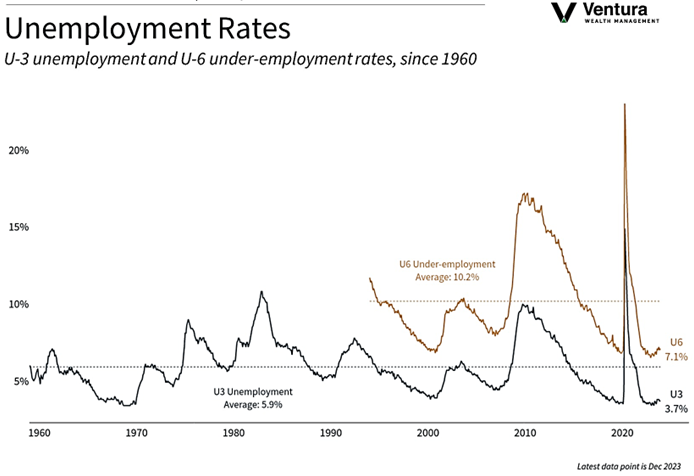

The relationship between jobs, inflation, interest rates, and FOMC policy remains a focal issue as we start 2024. Last week’s nonfarm payrolls report showed that the economy added 216,000 jobs in December, about 40,000 more than expected.5 The unemployment rate (chart right) remained level at 3.7% as there were declines in the labor force participation rate and the number of hours worked.6 Wages rose 4.1% year-over-year in December.7 These figures tilt towards higher inflation.

This week, we will receive the CPI and PPI inflation reports. Investment markets are expecting to see the first rate cuts from the FOMC at the March 19-20 meeting.8 The futures markets are indicating that the FOMC will lower rates to 3.75-4.00% by the end of 2024 – one full year ahead of the Federal Reserve’s projections.9 This “expectation gap” has the potential to cause an uptick in volatility as we move forward. The week ahead will be capped by earnings reports on Friday from several major financial institutions.

Chart of the Week

The unemployment rate remains near record-low levels. Friday’s nonfarm payrolls report showed the U3 unemployment rate at 3.7%. Expectations were for the rate to tick up to 3.8%. A inflationary reading below 4% is exceptional, but will be considered by the Fed to be inflationary.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Labor Statistics, MarketWatch.com

Statistic of the Week:

Forbes

Global Perspective: The Wall Street Journal

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.MarketWatch.com

5. Barron’s

6. Bureau of Labor Statistics

7. Barron’s

8. Barron’s

9. Barron’s