The Profit Margin: January 6, 2025

Statistic of the Week

30% of Americans make resolutions for the New Year, with younger Americans being more likely to do so than older cohorts. 49% of survey respondents between 18-29 said they will make a resolution, while only 18% of those 65 and older will do so. Overall, about 79% of respondents making resolutions will have one centered on health, while about 61% have a resolution about money. If one of your resolutions focuses on your personal finances – let your wealth manager know!

Global Perspective

For the first time in nearly two years, Turkey’s central bank cut interest rates. The main interest rate was reduced from 50% to 47.5%. The minimum wage was adjusted higher by 30%, a move that it characterized as “fiscal discipline.” The country’s inflation rate is still running north of 40%. Some labor unions were making demands for a 70% increase in wages.

Market Moving Events

Tuesday: ISM Services, JOLTS

Wednesday: FOMC Meeting Minutes, Consumer Credit

Thursday: Initial Jobless Claims

Friday: Consumer Sentiment, Nonfarm Payrolls Report

Commentary

Investors had much to celebrate in 2024. Domestic equity indices performed remarkably well. Volatility in the equity markets was relatively low. The S&P 500 had a record close 57 times over the course of the year and had no pullbacks of 10% or more.1 It is rare for the market to not have at least one correction in a calendar year. The most significant intra-year decline in 2024 was 8%.2

The yield curve spent much of 2024 normalizing from an inverted position. This means that shorter term bond yields were dropping while longer term bond yields were stable or rising. While not fully normalized, the yield curve today looks much healthier than it did one year ago. Assuming all else remains equal, one or two rate cuts from the Federal Reserve should officially “right the ship” and create a “normal” yield curve. The 10-year Treasury bond closed Friday with a yield of 4.6%.3 This is good news for bond investors, but bad news for borrowers – specifically prospective home buyers.

Of course, we do not know what 2025 will bring. The fundamentals of the U.S. economy look sound. Unemployment is low. Wage growth is solid. Forecasts for corporate earnings are firm. However, there are lingering issues. Equity valuations are elevated. The inflation rate is higher than the Fed would prefer. Geopolitical risk is omnipresent. And importantly, the market is expecting the incoming Trump administration to make quick progress on both the tax and regulatory fronts. We look forward to being both diligent and opportunistic in the year ahead. It won’t be boring!

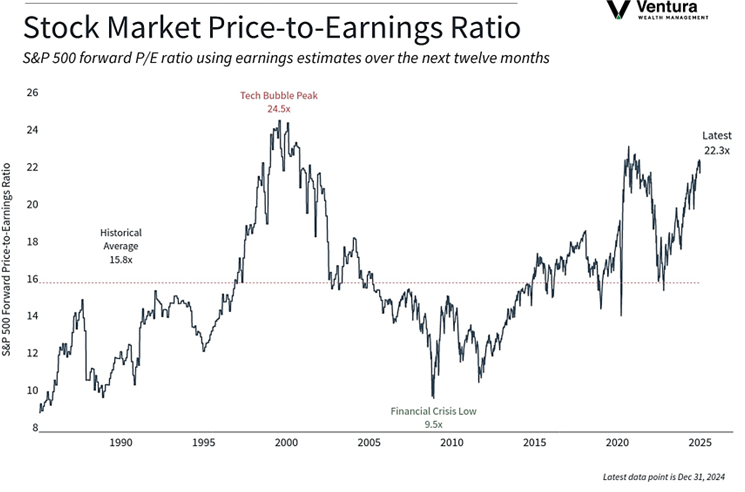

Chart of the Week

The S&P 500 is starting 2025 with a lofty Price-to-Earnings Ratio. With a forward P/E ratio of 22.3, the index is flirting with some of the highest valuations of the past quarter century. Corporate earnings, tax cuts, and interest rates will have to move favorably to allow the current rally to continue.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Economic Analysis

Statistic of the Week:

Pew Research

Global Perspective:

The Economist

Commentary:

1. Clearnomics.com

2. Clearnomics.com

3. MarketWatch.com