The Profit Margin: January 30, 2023

Statistic of the Week

In 2022, the percentage of laborers that were members of unions in the United States fell to

a new low. This came against a backdrop of several notable labor victories at high-profile

companies including Starbucks, Apple, and Amazon. 10.1% of the US labor force are union

members. Union membership peaked in the 1950’s when more than 33% of workers were

members.

Global Perspective

Brazil and Argentina are pushing forward on plans to create a common currency. Many economists believe that the move is ultimately infeasible, while political scientists are less certain. They argue that the two nations are trying to promote regional interdependence and less reliance on the US dollar.

Market Moving Events

Tuesday: Case Shiller Home Price Index

Wednesday: ISM Manufacturing, Fed Funds Rate Decision, Fed Chair Press Conference

Thursday: Jobless Claims

Friday: Nonfarm Payrolls, ISM Services

Commentary

Domestic equity markets continued their march higher last week as all three major averages finished the week in the black. The Nasdaq has rallied hard out of the gate – it jumped 4.32% last week as investors returned to some names that had been hit particularly hard in 2022.1 The S&P 500 rallied 2.47%.2 And last year’s leader, the DJIA, has been 2023’s laggard. It still put in a respectable gain of 1.81%.3 Fixed income yields inched higher.4 The 10-year Treasury finished Friday with a yield of 3.52%, up 0.04% from the week prior.5

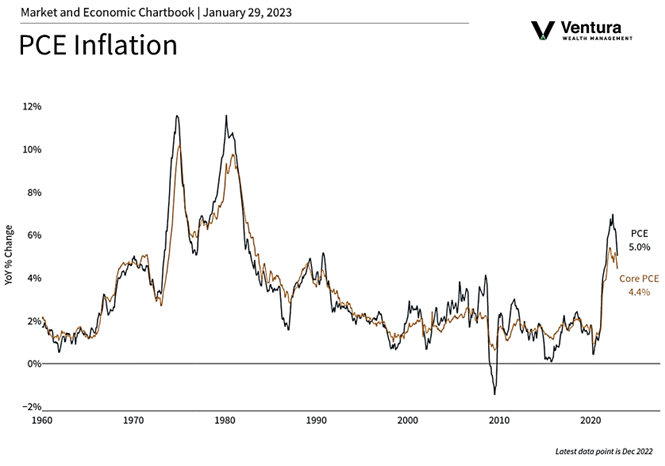

Last week we learned that the US economy grew at a rate of 2.9% and that inflation (chart right) is continuing to recede.6 Jobless claims were less than analysts expected and pending home sales had a surprising move higher.7 There is little debate that the consumer is starting to reign in their spending but not stop altogether. Combined, this creates an “ok” economic backdrop. The week ahead is critical. Earning’s season continues. The ISM will release its manufacturing and services indexes; both have been showing weakness as of late. On Friday we will receive January’s Nonfarm Payrolls report. But most important will be the FOMC meeting announcement on Wednesday. The market is expecting a rate hike of 0.25% to bring the target rate to 4.50% to 4.75%.8 Chair Powell’s press conference will be listened to carefully for potential policy shifts as the Fed looks to balance a potentially weakening economic backdrop.

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week: Clearnomics, Bureau of Economic Analysis, Barrons

Statistic of the Week:

The Washington Post

Global Perspective:

The Financial Times

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg

5.Bloomberg

6. Investor’s Business Daily

7. Investor’s Business Daily

8. Barron’s