The Profit Margin: January 3, 2023

Statistic of the Week

Russia and Iran are constructing a nearly 2000-mile trade route that is beyond the reach of international sanctions. The two nations are spending billions to quicken deliveries along the Caspian Sea and its corresponding rivers and railways. Russia has invested approximately $25 million to enhance the corridor to Iran. Iran is Russia’s third-largest grain importer.

Global Perspective

As 2022 closed, the war in Ukraine persists. The US estimates that both the Russians and Ukrainians have each lost 100,000 soldiers and that Ukraine has suffered 40,000 civilian casualties. 7 million Ukrainians have been internally displaced and 7.8 million have fled the country. Ukrainian generals are predicting a Russian offensive in early 2023.

Market Moving Events

Monday: US Markets Closed

Tuesday: US PMI, Construction Spending

Wednesday: ISM Manufacturing, FOMC Meeting Minutes, JOLTS

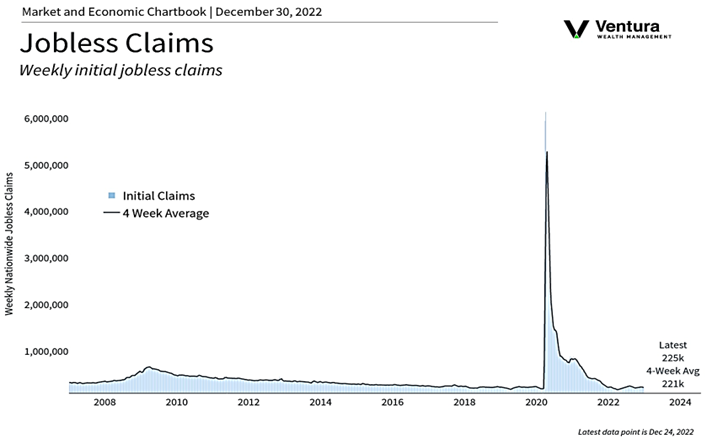

Thursday: Jobless Claims

Friday: Nonfarm Payrolls, ISM Services, Factory Orders

Commentary

Investors put 2022 to bed on a sour note. All three major equity averages finished the week lower. On the week, the DJIA fell 0.17%.1 It had the best annual return of the major averages, retreating 8.78%.2 The S&P 500 had the best weekly return, dipping only 0.14%.3 However, it finished the year down 19.44%.4 And the Nasdaq, which had massive gains during the pandemic, was the week and year’s worst performer, down 0.30% and 33.10%, respectively.5 It should be noted that the Nasdaq finished the week not far from its bear market lows. Interest rates continued their recent march higher. The yield on the 10-year Treasury closed Friday at 3.83%, up 0.08% from the week prior.6

What made 2022 for investors so challenging was the dual bear markets in equities and fixed income – safe havens were few and far between. Energy was the only S&P sector to finish the year with a positive return.7 We start 2023 with a familiar theme: recession watch. Investors have been looking for a recession “three to six months out” since last January. It has yet to arrive. This is prompting some analysts to theorize that the US economy is moving through a “rolling” recession8 – where different portions of the economy slow at various times. This is plausible. While there is still a lack of certainty around both the “if” and “when” of a 2023 recession, investors will be carefully watching the release of the Fed meeting minutes and Nonfarm Payrolls report this week for clues.

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week: Clearnomics, CNBC.com

Statistic of the Week:

Bloomberg Business

Global Perspective:

The Economist

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg

5.Bloomberg

6.Bloomberg

7.Investor’s Business Daily

8. Investor’s Business Daily