The Profit Margin: January 29, 2024

Statistic of the Week

You do not need to have a traditional office job or advanced degree to earn six figures. For example: the average base salary for an American truck driver is $103,594. Pay for truck drivers can range from $52,000 to over $200,000. Managers for fast food restaurants frequently earn $100,000 or more. And car salespeople frequently fall in the $100,000 income range. A six-figure income does not equal financial security. A recent study found that 45% of those earning $100,000 or more are still living paycheck to paycheck.

Global Perspective

The Turkish central bank has been losing its battle against inflation. The inflation rate in the country is approaching 65%. The central bank just hiked its key rate by 250 basis points to 45%. The Turkish lira hit a new record low against the U.S. dollar earlier this month.

Market Moving Events

Tuesday: Consumer Confidence

Wednesday: FOMC Meeting Announcement

Thursday: Jobless Claims, ISM Manufacturing

Friday: Nonfarm Payrolls, Factory Orders, Consumer Sentiment

Commentary

Equity markets retained their upbeat disposition last week as earnings season progressed, inflation data was tame, and GDP data was solid. All three major averages finished the week in positive territory. The Nasdaq is the year-to-date leader. It rallied 0.94% last week.1 The S&P 500 rose 1.06%, the week’s best performer.2 And the DJIA brought up the rear, climbing 0.65%.3 Yields rose on the week, but did not close at their highs. The yield on the 10-year Treasury finished Friday at 4.14%, up five basis points from the week prior.4

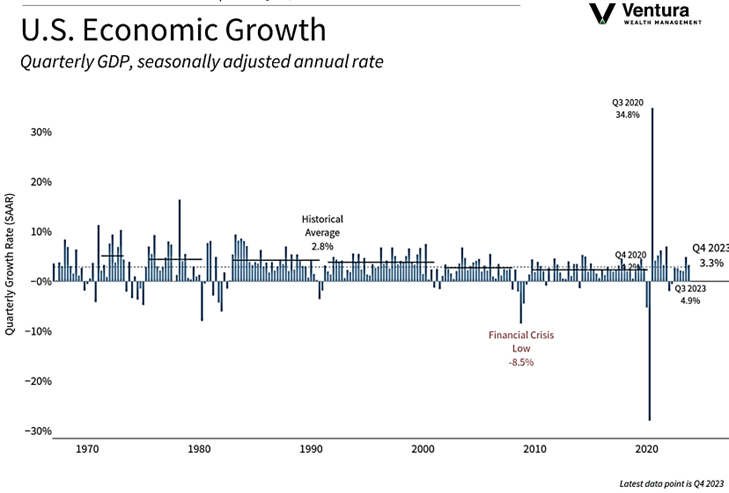

Investors remain upbeat and have good reason to do so. GDP (chart right) for the fourth quarter was stronger than expected. Notably, the economy grew at a real (inflation-adjusted) rate of 4.1% over the past six months.5 We also learned last week that the Federal Reserve’s key inflation rate, Core PCE, fell to an annual rate of 2.9% from 3.2%, and that it is annualizing at a rate of 1.5% over the past three months.6 We will hear from the FOMC this week as there will be a meeting announcement on Wednesday. The Fed’s current dilemma: how fast and when should they begin to cut rates. Currently, the futures markets are predicting between five and six rate cuts in 2024 with near 50/50 odds of cuts beginning in March.7 But, with the economy growing at a good clip and inflation coming lower, will the Fed be in any rush to adjust policy rates?

The week ahead will be dominated by a series of key earnings reports, the FOMC meeting announcement, and key readings on the mindset of the consumer.

Chart of the Week

The U.S. economy grew at a 3.3% annualized rate in the fourth quarter, faster than analysts expected. Analysts had expected a growth rate of approximately 2%. For 2023, the economy grew at a pace of 2.5%, an increase from 2022.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Economic Analysis, Yahoo! Finance

Statistic of the Week:

MarketWatch.com

Global Perspective:

CNBC International

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.MarketWatch.com

5. Investor’s Business Daily

6. Investor’s Business Daily

7. Barron’s