The Profit Margin: January 27, 2025

Statistic of the Week

The Brazilian government has revised down its coffee crop forecasts, leading to a surge in coffee futures contracts. Arabica reached a record high last week, while robusta remains close to peak levels. A key contributing factor is the below-average rainfall in Brazil, particularly in the main coffee-producing region, Minas Gerais. It has received 53% of its usual precipitation for this time of the growing season. Brazil is currently facing its driest weather conditions since 1981. Additionally, Colombia and other prominent producers in South and Central America are experiencing similar challenges.

Global Perspective

The Bank of Japan has increased its primary interest rate to the highest level in 17 years, reflecting a more hawkish perspective on inflation. This decision has sparked speculation regarding potential further rate increases down the line. Following this announcement, the yen strengthened.

Market Moving Events

Tuesday: Durable-Goods Orders, Consumer Confidence

Wednesday: FOMC Meeting Announcement, Fed Chair Press Conference

Thursday: Initial Jobless Claims, GDP

Friday: Personal Income and Spending, PCE price Index, Employment Cost Index

Commentary

Domestic equity markets experienced another robust week, with all three major indices recording gains. The S&P 500 reached a new all-time high, while the DJIA led the week with a 2.15% increase.1 The S&P climbed by 1.74%,2 and the Nasdaq saw a rise of 1.65%.3 In contrast, fixed income markets remained relatively stable during the shortened trading week, with the yield on the 10-year Treasury holding steady at 4.63%.4

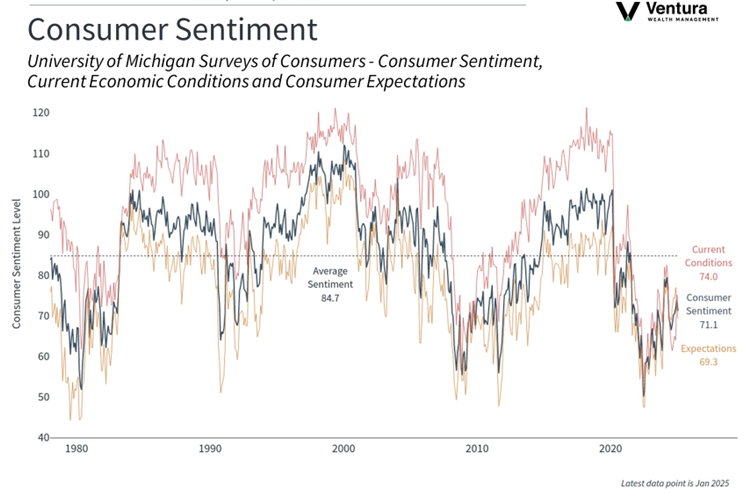

Last week was also light in terms of significant economic news releases. The Consumer Sentiment report’s headline figure aligned with analyst expectations. While other details in the report did not attract much attention, they are noteworthy. Inflation expectations among consumers increased from 2.8% in December to 3.3%, marking a 0.5% rise in expected inflation for the next 12 months.5 Additionally, 47% of consumers anticipate a rise in unemployment, the highest level recorded since the pandemic.6 We will closely observe how these sentiment indicators influence economic activity in the upcoming months.

Looking ahead, the coming week features several important earnings reports and key economic data releases. A meeting announcement from the FOMC is scheduled for Wednesday, followed by a press conference with Chair Powell. Although no changes to monetary policy are anticipated, market participants will look for responses from Chair Powell regarding President Trump’s calls for lower interest rates. Additionally, we will see the release of fourth-quarter GDP and the PCE price index later in the week.

Chart of the Week

Consumer sentiment remains low. The latest reading from the University of Michigan Consumer Sentiment Index showed a decline for the first time in six months, falling short of analysts’ forecasts. The decline was broad-based, across wealth, age, and income cohorts.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Reuters, University of Michigan

Statistic of the Week:

BarChart.com

Global Perspective:

Bloomberg News

Commentary:

1. Bloomberg

2. Bloomberg

3. Bloomberg

4. MarketWatch.com

5. Reuters

6. Reuters

7. Barron’s

8. Investor’s Business Daily

9. Barron’s