The Profit Margin: January 23, 2023

Statistic of the Week

The United States government reached its debt limit this past Thursday. The current ceiling, standing at $31.4 trillion, was last increased in December 2021. The debt ceiling may only be raised by Congress. The Treasury intends on utilizing “extraordinary measures” to make the $400 billion of cash it has on hand last until the ceiling is raised again. Analysts predict June 5 is the real deadline.

Global Perspective

The volatility in the stock market in 2022 prompted investors to make rash decisions. According to a recent study by Sofi, more than a third of investors (37%) admitted to making “impulsive” investment decisions – buys and sells. A positive from the survey data was that about 29% of investors looked to go bargain hunting and made purchases at what they believed were discounted levels.

Market Moving Events

Monday: Leading Economic Indicators

Tuesday: S&P Manufacturing and Services PMI Indices

Thursday: Jobless Claims, GDP, Durable Goods Orders, New Home Sales

Friday: PCE Price Index, Consumer Sentiment, Pending Home Sales

Commentary

It was a volatile week on Wall Street as investors navigated significant crosscurrents. The major indices were left mixed on the week. The DJIA fared the worst retreating 2.70%.1 The S&P 500 was relatively flat, down 0.66%.2 And the Nasdaq, which jumped out of the gate to start 2023, was able to finish the week in the black, up 0.55%.3 Despite all the movement in the equity markets, fixed income yields were relatively unchanged. The 10-year Treasury finished the week with a yield of 3.48%, down 0.03% from the week prior.4

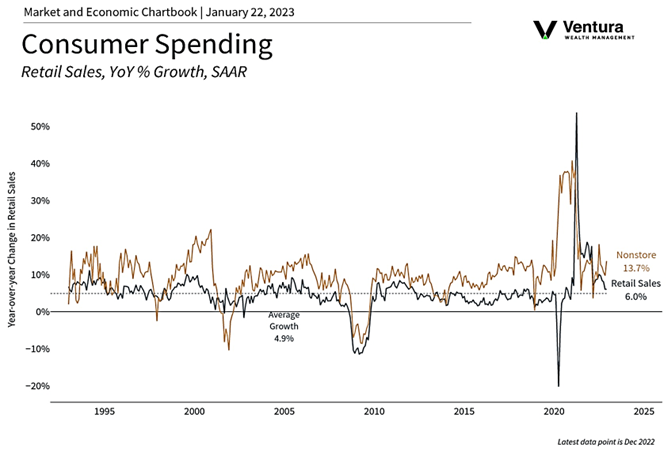

Earnings’ releases, retail sales, inflation, employment data, and the debt ceiling (See the “Statistic of the Week) were central to last week’s market action. While it’s too early to have a full picture of fourth quarter earnings, so far, the “worst case” scenario has not played out. Earnings’ season will continue this week with multiple blue-chip companies reporting.5 Retail sales (chart right) are illustrative of a wary consumer as corporate layoffs gain steam. While there are headline garnering layoffs at some major tech firms, the initial jobless claims figure for the week ended January 14th came in better than expected.6 There are no clear signs of deterioration in the labor market (yet). Last week’s Producer Price Index again showed inflation heading in the right direction; on Friday we will receive the Fed’s favorite inflation reading, the PCE deflator. This data point, along with others and corporate earnings, could make for an eventful week.

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week: Clearnomics, Census Bureau, The Wall Street Journal

Statistic of the Week: Yahoo! Finance,

Global Perspective:

Money Magazine

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg

5. Investor’s Business Daily

6. Investor’s Business Daily