The Profit Margin: January 21, 2025

Statistic of the Week

President Trump was sworn in as the 47th President of the United States yesterday. Originally, inaugurations took place on March 4th; however, the 20th Amendment, ratified in 1933, changed Inauguration Day to January 20th to align it more closely with the commencement of the new Congress. It’s important to note that not every inauguration has occurred on the 20th. When the 20th falls on a Sunday, the public ceremony is typically rescheduled to the following Monday, while the President takes the private oath on Sunday.

Global Perspective

The German economy experienced a decline for two straight years. It contracted by 0.3% in 2023 and 0.2% in 2024. A significant factor was the 3.8% decrease in construction spending. Furthermore, the manufacturing sector saw a 3% reduction, which was partially attributed to challenges in the automobile industry stemming from competition with Chinese electric vehicle manufacturers.

Market Moving Events

Wednesday: Leading Economic Indicators

Thursday: Initial Jobless Claims

Friday: Existing Home Sales, Consumer Sentiment

Commentary

Last week’s better-than-anticipated inflation data triggered a relief rally in both the equity and fixed income markets. All three major domestic equity indices concluded the week in positive territory, with the DJIA leading the way, climbing 3.69%.1 The S&P 500 broke a two-week losing streak, recording its best weekly percentage increase since the election with a rise of 2.91%.2,3 Meanwhile, the Nasdaq lagged slightly behind, gaining 2.45%.4 Additionally, the yield on the 10-year Treasury bond experienced its largest weekly decline since the week of November 29th,5 dropping 0.14% over the week to finish Friday at 4.63%.6

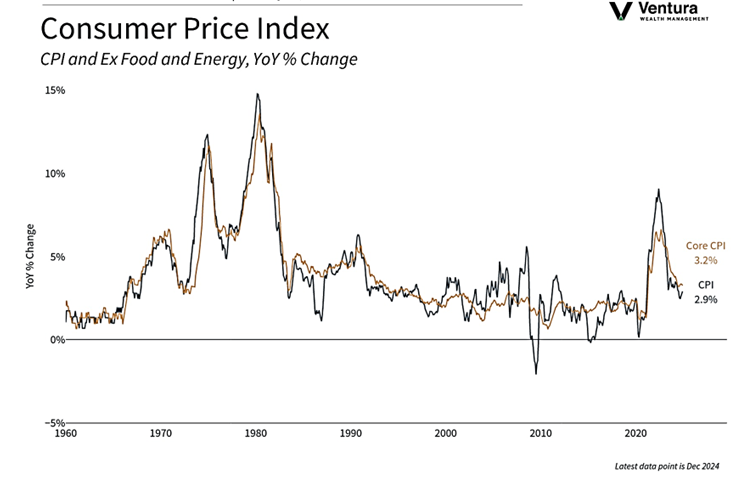

The major banks kicked off earnings season last week with impressive reports. Their strong earnings, combined with inflation data that fell short of analysts’ expectations, contributed to the upward momentum in equity markets. Both the Producer Price Index (PPI) and Consumer Price Index (CPI, chart right) underscored an ongoing disinflation narrative. Although inflation rates have stabilized, with an average headline CPI figure of 2.7% over the last three months,7 inflation continues to exceed the Federal Reserve’s 2% target making further interest rate cuts less likely. The incoming Trump administration will likely advocate for a reduction in the target interest rate. However, anticipated new tariff policies—an additional 10% on Chinese goods and 25% on imports from Mexico and Canada8—could potentially elevate inflation figures. Moreover, while this increase has yet to be reflected in consumer prices, crude oil prices have surged over 12% in the past four weeks.9 Inflation may have diminished, but it poses a potential challenge for the incoming Trump administration.

Chart of the Week

In December, the Consumer Price Index increased by 0.4%, which was marginally higher than what analysts had predicted. Conversely, the core index, which excludes food and energy prices, saw a rise of 0.2% for the month, falling slightly short of analyst expectations. On a year-over-year basis, the overall index recorded a 2.9% increase, while the core index stood at 3.2%.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Labor Statistics

Statistic of the Week:

National Constitution Center

Global Perspective:

The Economist

Commentary:

1. Bloomberg

2. Barron’s

3. Bloomberg

4. Bloomberg

5. Barron’s

6. MarketWatch.com

7. Barron’s

8. Investor’s Business Daily

9. Barron’s