The Profit Margin: January 2, 2024

Statistic of the Week

Mortgage levels in the U.S. ended the year at their lowest levels since May. The average 30-year fixed mortgage dropped to 6.61%, down from a peak of 7.79% in October. Rates are still approximately double the levels they were at the start of 2022. There is ample speculation that the recent decline in rates could start to heat up a very tight and slow housing market in the spring.

Global Perspective

Is joining the richest 1% one of your New Year’s resolutions? Depending on where you live across the globe, this task could be easier or harder. To be in the richest 1% in Monaco, the highest level of the countries examined, you’d need about $12.4 million. In the U.S., $5.1 million makes the cut. The Philippines, which is one of the lowest of the 25 nations studied, your net worth would have to be $57,000.

Market Moving Events

Monday: U.S. Markets Closed

Tuesday: Construction Spending

Wednesday: ISM Manufacturing, Auto Sales

Thursday: Jobless Claims

Friday: Nonfarm Payrolls, ISM Services, Factory Orders

Commentary

While the S&P 500 was not able to fully regain the territory it lost in 2022, 2023 ended up being a solid recovery year as investors pushed the index higher for the last nine consecutive weeks.1 2023 was the first year since 2012 where the S&P 500 did not have at least one record close.2 But, bullish sentiment has remained fully in control since the Fed’s apparent “pause” on further interest rate hikes, allowing the index to flirt with its all-time record. The Nasdaq, not to be left out, had its best year since ‘03,3 yet it too was unable to capture its previous record. Treasury yields fell substantially in December. The yield on the 10-year dropped 0.48% on the month, the biggest December decline since the financial crisis in ’08, following a decline of 0.53% in November.4

In the short-term, equity and fixed income markets are due for a pullback. Do not be surprised if the New Year brings a fresh wave of volatility. There will be plenty of economic data in this shortened trading week. Friday’s Nonfarm Payroll’s report is expected to show the U.S. economy added 170,000 jobs in December with the unemployment rate coming in at 3.8%.5 The strength of the consumer is paramount to the “soft landing” thesis. Less-than-stellar employment figures could be used as a justification for profit taking. And, those looking to the history books for predictions about market performance during election years, can take some solace. Since 1883, the last two years of a presidential term have returned 772%, while the first two returned 336.5%.6 We will see what 2024 brings. Happy New Year!

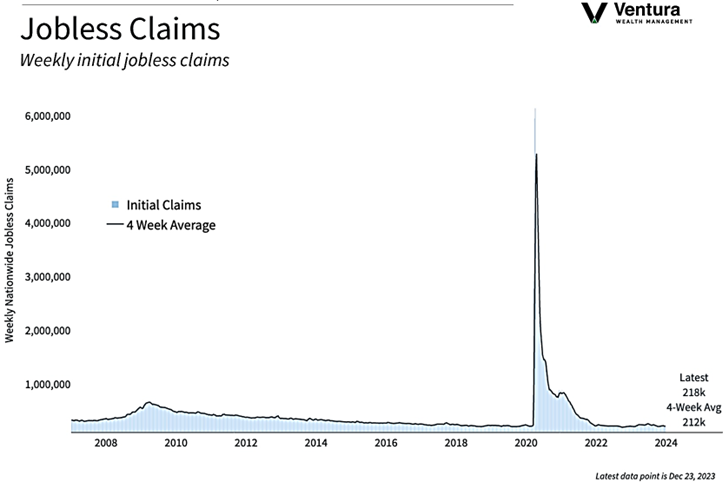

Chart of the Week

Initial jobless claims continue to come in at a low level. For the week ended December 23rd, there were 218,000 claims. The four-week average sits at 212,000.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Labor Statistics

Statistic of the Week:

Businessweek

Global Perspective:

Bloomberg Business

Commentary:

1.Bloomberg

2. Barron’s

3. Investor’s Business Daily

4.Yahoo! Finance

5. MarketWatch.com

6. Investor’s Business Daily