The Profit Margin; January 16, 2024

Statistic of the Week

By now, we have almost all seen the terrifying images of the Alaska Airlines Flight 1282 that had to make an emergency landing after a door plug blew out. Passengers who were on the flight recently received an apology email from the carrier. The note said that the airlines was proving passengers with 24/7 access to mental health resources and $1,500 “to assist with any inconveniences.” There were 171 passengers aboard the flight when the malfunction occurred.

Global Perspective

The current vice president, Lai Ching-te, was elected to be the next president of Taiwan over the weekend. This was the Democratic Progressive Party’s third consecutive presidential victory. The win poses as problem as China warned that a reelection of the party and of Ching-te, who they deem a “troublemaker” and separatist, would increase the likelihood of conflict.

Market Moving Events

Monday: U.S. Markets Closed

Wednesday: Retail Sales, Industrial Production, Beige Book

Thursday: Jobless Claims, Housing Starts, Building Permits

Friday: Existing Home Sales, Consumer Sentiment

Commentary

Despite mixed inflation data last week, equity markets resumed their march higher. All three major indices were able to notch positive marks. The Nasdaq was the week’s leader, rallying 3.09%.1 The S&P 500 rose 1.84%.2 And the DJIA brought up the rear, climbing 0.34%.3 The move on the S&P was enough to bring that index’s year-to-date performance into the black, while both the DJIA and Nasdaq are still slightly negative on the year.4 All three indices have been positive ten of the past eleven weeks.5 The uptick in equities was accompanied by a decline in fixed income yields. The 10-year Treasury fell 0.09% to close Friday with a yield of 3.94%.6

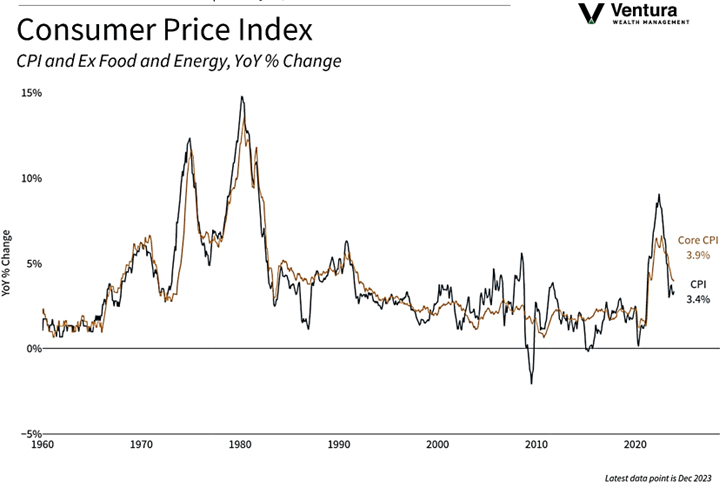

The Consumer Price Index (chart right) came in slightly hotter than expected, while the Producer Price Index signaled deflation in production costs.7 These figures reinforced the market’s conviction that the FOMC would begin cutting target interest rates in March. Currently, futures markets are forecasting a 79% chance of a March rate cut8 and a total of 1.75% of cuts throughout 2024.9 This does not square with the Fed’s projections and is a point of potential contention and volatility. Multiple members of the FOMC are speaking this week – we will see if they try to put a damper on the market’s lofty expectations. Accompanying “Fed speak,” we will receive a much-anticipated retail sales figure and multiple housing reports. All should provide insight on the current state of the consumer. To top things off, earnings’ season kicks into high gear with several key players reporting fourth quarter results. Stay tuned.

Chart of the Week

Consumer prices rose 0.3% in the month of December and 3.4% from one year ago. The inflation figures, released last week, were slightly above analyst expectations, 0.2% and 3.2%, respectively. In 2022, year-over-year inflation was measured at 6.4%.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Labor Statistics, CNBC.com

Statistic of the Week:

The Washington Post

Global Perspective:

NBC News, CNN

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg

5. Investor’s Business Daily

6.MarketWatch.com

7. Barron’s

8. Barron’s

9. Investor’s Business Daily