The Profit Margin: February 6, 2023

Statistic of the Week

2021 and 2022 became known as the “Great Resignation” as workers shifted employment in search of better compensation and opportunities. 50 million workers quit their jobs in 2022 after 47 million had quit in 2021. However, the “Great Resignation” may be turning into the “Great Regret.” A recent Paychex survey found that 8 in 10 of those who have quit now regret that decision.

Global Perspective

The Bank of Japan is in the process of appointing a new leader, just as the central bank prepares to tighten monetary policy for the first time in over 15 years. Since December, the Bank of Japan has purchased of $240 billion in bonds (6% of Japan’s GDP) as the bank defends its price cap on 10-year government bond yields and a floor on government bond prices.

Market Moving Events

Tuesday: Consumer Credit

Wednesday: Wholesale Inventories

Thursday: Jobless Claims

Friday: Consumer Sentiment, Federal Budget Balance

Commentary

Investors were left with much to digest last week. There was a large amount of earnings’ reports, several key economic releases, and the much-anticipated Federal Reserve rate announcement coupled with Fed Chair Powell’s press conference. With that backdrop, equities were mostly positive. The Nasdaq continued its strong kickoff rally for 2023, up 3.31% on the week.1 The S&P 500 rose 1.62%.2 The DJIA was close to unchanged, down 0.15%.3 While yields were volatile, there was little weekly change. The 10-year Treasury yield finished Friday at 3.53%, up 0.01% from the week prior.4

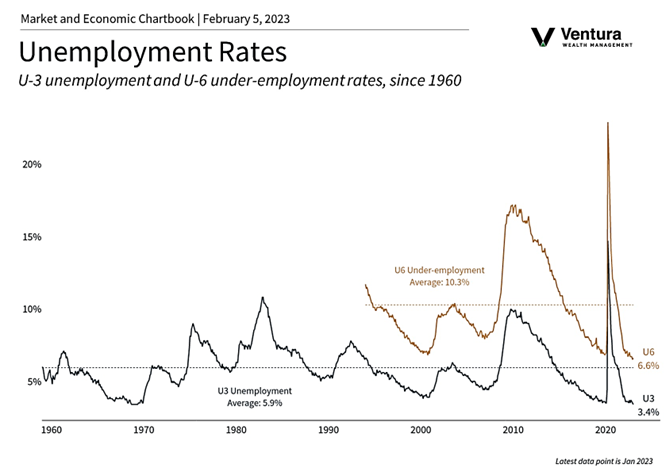

The overall tenor of the reports was positive enough. The Federal Reserve raised target rates as expected by 0.25%. Chair Powell’s press conference was generally upbeat as he made mention of disinflation (“disinflation” is the reduction of the rate of inflation, where “deflation” is when prices actually fall) and a soft landing.5 In his press conference, he said that “it would be premature to declare victory.”6 But, it does appear that the Fed is starting to take a less-hawkish stance – a stance that investors are likely to appreciate. The monthly jobs report (chart right) demonstrated, yet again, a stubbornly strong labor market. Wage growth year-over-year came in at 4.4% in January.7 While the rate is slowing (it was 4.8% in December),8 it is a potential spoiler for a more-accommodative Federal Reserve. The week ahead is very light on data. Volatility may tick up.

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week: Clearnomics, Bureau of Labor Statistics, CNBC

Statistic of the Week:

CNBC.com

Global Perspective:

The Economist

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg

5. Inventor’s Business Daily

6. Barron’s

7.Bureau of Labor Statistics

8. Barron’s