The Profit Margin: February 5, 2024

Statistic of the Week

The NFL’s Super Bowl is this weekend. The romance between music star Taylor Swift and Kansas City Chief’s player Travis Kelce has been a sensational story, dominating news coverage around the game. A marketing company conducted research and believes that the relationship has generated about $331 million for the NFL and the Chiefs. This figure does not include media coverage during the Chiefs last game or the upcoming Super Bowl.

Global Perspective

2023 saw one notable change in the labor markets. The number of Americans hired by international firms last year rose by 62%. These positions are primarily remote. This is happening at the same time American firms are scaling back on remote workers. American employees are most likely to be hired by companies from Canada, the U.K., France, Australia, and Singapore.

Market Moving Events

Monday: ISM Services

Wednesday: Consumer Credit

Thursday: Jobless Claims, Wholesale Inventories

Commentary

Solid earnings reports outweighed hawkish Federal Reserve commentary and U.S. equity markets marched higher on the week. All three major domestic indices finished the week in positive territory and the S&P 500 hit a record high on Friday. It should be noted that almost all the week’s gains came on Friday after see-saw action for much of the week. The DJIA was the week’s leader, rallying 1.42%.1 The S&P 500 rose 1.38%.2 And the Nasdaq brought up the rear, climbing 1.12%.3 Surprisingly, yields were down on the week, but well off their lows. The 10-year Treasury finished Friday with a yield of 4.02%.4

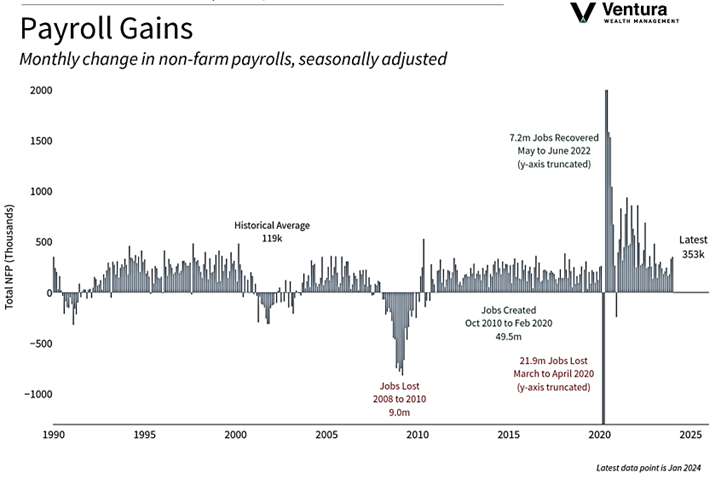

In last Wednesday’s FOMC meeting announcement and subsequent press conference, Chair Powell all but eliminated the possibility of a rate cut in the month of March, much to the chagrin of market participants.5 This hawkish commentary soured sentiment. However, strong earnings’ reports by tech leaders buoyed sentiment and the nonfarm payrolls report (chart right) demonstrated that workers remain in good shape. The 353,000 jobs that were added in January were double analyst estimates and the unemployment rate has been below 4% since December 2021.6

The week ahead is notably light on both economic data releases and earnings reports. The week is peppered with public comments from several Federal Reserve officials. Geopolitical events are still a serious concern. Equity markets are undoubtedly extended as we enter the week. Caution is warranted. It would not take much for markets to pull back.

Chart of the Week

The U.S. economy surpassed analyst estimates and added 353,000 jobs in the month of January. The U3 unemployment rate held steady at 3.7%.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Labor Statistics

Statistic of the Week:

MarketWatch.com

Global Perspective:

CNBC.com

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.MarketWatch.com

5. Investor’s Business Daily

6. Barron’s

7. Barron’s