The Profit Margin: February 3, 2025

Statistic of the Week

The United States has unveiled new tariffs targeting imports from Mexico, Canada, and China. An extra 10% tariff has been imposed on nearly all Chinese products, which are already subject to a 25% tariff. Goods from Mexico and Canada will now incur a 25% tariff, while Canadian oil and gas will face a partial 10% tariff. These new tariffs are set to take effect on February 4th.

Global Perspective

Almost 50% of all imports to the United States, amounting to over $1.3 trillion, come from Canada, China, and Mexico. Economists fear the new tariffs could lead to a decrease in imports of as much as 15%. The auto, food, and energy industries in the U.S. seem to be the most vulnerable. Specifically, the 25% tariff on imports from Mexico and Canada is expected to increase the cost of a new vehicle by approximately $3,000. Mexico accounts for around 60% of the U.S. vegetable imports and about half of the imports for fruits and nuts. Economists predict that the tariffs could result in a 16% reduction in Mexico’s GDP.

Market Moving Events

Tuesday: Job Openings, Factory Orders

Wednesday: ADP Employment, ISM Services,

Thursday: Initial Jobless Claims, Productivity

Friday: Nonfarm Payroll Report, Wholesale Inventories, Consumer Sentiment, Consumer Credit

Commentary

Despite an unexpected announcement from the Chinese AI company DeepSeek, which unsettled the technology sector, and escalating trade tensions due to tariffs, markets have shown remarkable resilience since President Trump’s inauguration. The S&P 500 has achieved its best start to a presidential term since 2013.1 All three major domestic equity indices have posted notable gains since the beginning of the year. The DJIA has risen by 4.7%.2 The S&P 500 has grown by 2.7%.3 The Nasdaq has advanced by 1.6%,4 even after a week characterized by significant volatility driven by reactions to DeepSeek. Treasury yields declined – the 10-year Treasury closed Friday with a yield of 4.54%, down 0.09% from the week prior.5

Investors are expected to focus on earnings reports, important economic data releases, and updates regarding the tariff situation in the days ahead. Several Federal Reserve officials are scheduled to give public comments. Notably, the FOMC did not alter policy in their meeting last week. Also, the upcoming Nonfarm Payroll report will be closely monitored. It is expected that the economy added 175,000 jobs in January and that the unemployment rate remained the same at 4.1%.6 We expect news around tariffs, specifically those pertaining to Mexico, Canada, and China, to be major news events. More than 40% of total U.S. trade is with these three nations.7 Tariffs are ultimately a tax on the consumer and are inflationary. Both Mexico and Canada have already countered U.S. tariffs with tariffs on American goods. We expect China to follow. Further escalation could heighten market volatility.

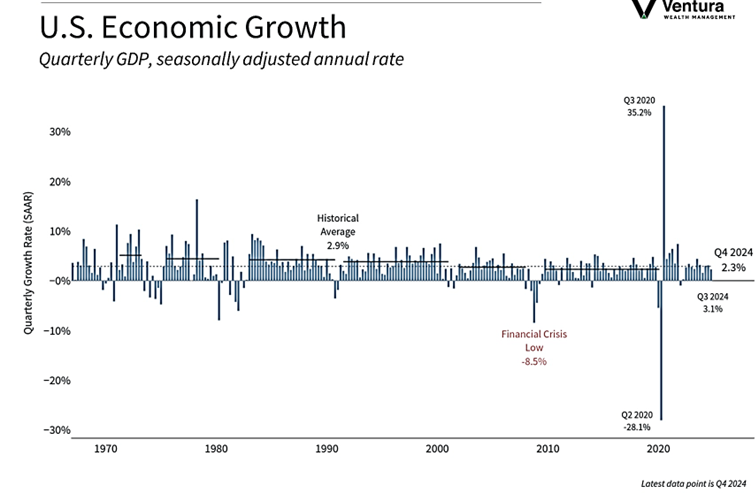

Chart of the Week

During the fourth quarter, the economy increased at an annualized rate of 2.3%, falling short of analyst predictions of 2.5%. For the entirety of 2024, the economy grew by 2.5%, marking a deceleration from the 3.2% growth recorded in 2023. Economists project a growth rate of 2.1% for 2025.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Reuters, University of Michigan

Statistic of the Week:

Council on Foreign Relations, PBS

Global Perspective:

Bloomberg News

Commentary:

1. MarketWatch.com

2. Bloomberg

3. Bloomberg

4. Bloomberg

5. MarketWatch.com

6. MarketWatch.com

7. United States Census Bureau