The Profit Margin February 27, 2023

Statistic of the Week

In the second half of 2022, the value of the US housing market fell about 4.9%. After a peak value of $47.7 trillion in June, the total value of American homes declined by about $2.3 trillion. This pullback in prices is the largest since the second half of 2008 when prices fell 5.8%. High mortgage rates are largely being blamed. (Realtors are saying that there is still ample demand). The median sale price was $383,249.

Global Perspective

A warm winter and a major uptick in liquified natural gas imports helped push European natural-gas futures below $53 / megawatt hour for the first time in 18 months. These factors helped offset Russian supply disruption. At the same time, the EU’s carbon-trading market hit $107/ton for the first time. These permits allow companies to emit pollutants up to a certain cap. The recent rise in the price is attributed to forecasts of a rise in industrial output.

Market Moving Events

Monday: Durable Goods, Pending Home Sales

Tuesday: Consumer Confidence

Wednesday: ISM Manufacturing

Thursday: Jobless Claims

Friday: ISM Services Index

Commentary

Another week, another “hot” inflation reading. And once again, the fear that the Federal Reserve will ultimately cause a recession trying to combat stubbornly high inflation dominated the investor psyche. All three major equity indices retreated on the week and bond yields rose. The S&P 500 was the week’s best performer, falling 2.67%.1 The DJIA retreated 2.99%.2 And the Nasdaq faired the worst, dipping 3.33%.3 Fixed income prices fell as bond yields rose. The yield on the 10-year Treasury rose 0.12% to finish Friday with a yield of 3.95%.4

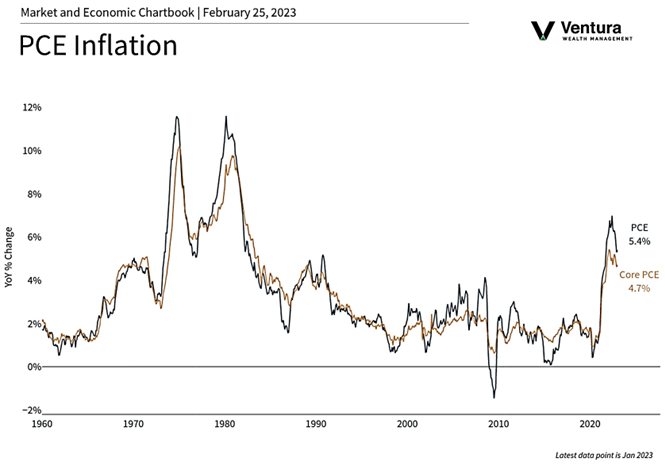

Let’s take a closer look at the inflation situation. Core PCE (chart right, gold line) was higher than expected for January This is a similar result to recent CPI and PPI readings. Just as inflation did not go up in a straight line, it is unlikely that it is going to come down in a straight line. For the January readings, analysts had been expecting an uptick – but not to the extent we received. It is clear that inflation is decelerating. But it is not decelerating as quickly as anyone, especially the Federal Reserve, would prefer. The persistence of higher-than-average inflation, and jawboning by Fed officials, has now caused the futures markets to price in three, 0.25% fed funds rate hikes between now and the June meeting.5 With multiple Federal Reserve governors on the speaking circuit this week, and several major retailers announcing earnings, volatility can be expected.

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week: Clearnomics, Bureau of Economic Analysis

Statistic of the Week:

Bloomberg Business

Global Perspective:

The Economist

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg

5. Inventor’s Business Daily