The Profit Margin February 21, 2023

Statistic of the Week

While consumer spending remains strong, there is little debate that inflation is taking a bite out of household budgets. So much so that a recent study found that 6 in 10 Americans are looking for short-term work or a side job to help ends meet. “Overemployment” is a trend that is spanning the tax brackets.

Global Perspective

Ueda Kazuo has been nominated to be the next governor of the Bank of Japan. Kuroda Haruhiko will vacate the position in April. Mr. Ueda was a “surprise choice” for the position as nominees have typically come from within the BOJ – he is an academic. Along with the rest of the world, Japan’s economy has been struggling. It’s most recent GDP reading showed an annualized growth rate of 0.6%.

Market Moving Events

Monday: US Markets Closed

Tuesday: Existing Homes Sales

Wednesday: FOMC Meeting Minutes

Thursday: Jobless Claims, GDP (revision)

Friday: Consumer Spending and Income, PCE, New Home Sales, Consumer Sentiment

Commentary

Two hotter-than-expected inflation readings last week caused some heartburn on Wall Street. While the major averages finished the week mixed and mostly flat, there was a notable churn across individual positions and asset classes. The S&P 500 was the week’s worst performer; it finished the week down 0.28%.1 The DJIA dipped 0.13%.2 And the Nasdaq was able to squeeze out a gain, rallying 0.59%.3 Fixed income yields rose on the concerns of sticky inflation. The 10-year Treasury yield rose 0.09% on the week and closed Friday at 3.83%.4

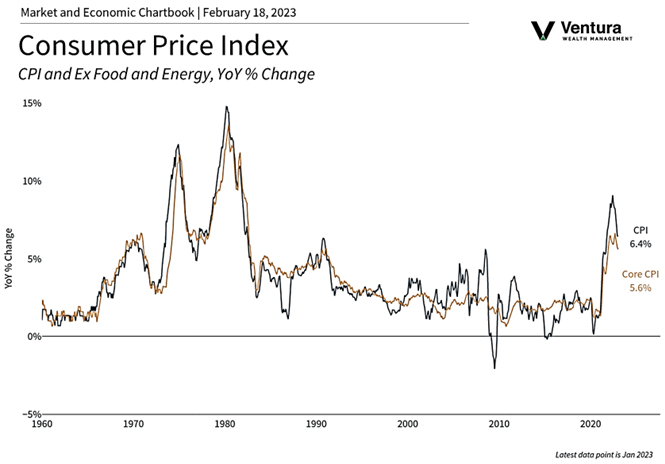

There have been multiple data points that underscored an acceleration of growth in the US economy in the month of January.5 That acceleration helped speed up inflation as seen in the CPI (chart right) and PPI. While analysts believed that the inflation rate would pick up in January, the readings were still above estimates. This caused several of the major banks to increase their projection for the Federal Reserve’s “terminal rate” on fed funds to 5.50%.6 This is also being reflected in the futures market, where odds of a 0.50% rate hike in March have been increasing.7

The week ahead is relatively light on economic data. However, the release of the FOMC meeting minutes on Wednesday and the PCE inflation reading on Friday have the potential to move markets. Inflation and Fed policy remain center stage.

Chart of the Week

Market Moving Events:

MarketWatch.com

Chart of the Week: Clearnomics, Bureau of Labor Statistics, CNBC

Statistic of the Week:

Forbes.com

Global Perspective:

The Economist

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg

5. Inventor’s Business Daily

6. Barron’s

7. Investor’s Business Daily