The Profit Margin: February 20, 2024

Statistic of the Week

Feeling the pinch as a result of increases to your homeowners or auto insurance? You are not alone. Insurance rates are up across the board. In the auto space, full coverage auto insurance was up 26% year over year. The average national premium is now $2,543. Missouri saw the biggest increase in dollar terms – up $858 or 44.16%. The average premium hike in New Jersey was the second largest in dollar terms, but most in percentage terms. New Jersey auto premiums rose $801 or 45.69%.

Global Perspective

Argentina claimed a crown it really does not want. The South American nation now has the highest inflation rate in Latin America. In January, inflation rose to 254%, up from 211% in December. The country’s new president, Javier Milei, devalued the peso and abolished price controls as part of his “shock therapy” economic reforms. He has cautioned that there is more pain to come for the beleaguered economy.

Market Moving Events

Monday: U.S. Markets Closed

Tuesday: Leading Economic Indicators

Wednesday: FOMC Meeting Minutes Released (January)

Thursday: Jobless Claims, Existing Home Sales

Commentary

A set of hotter-than-expected inflation figures last week helped wrangle market euphoria, pushing all three major domestic indices into the red. And while trading was volatile, the damage to the broad indices was relatively contained. The DJIA was the week’s best performer, dropping 0.11%.1 The S&P 500 retreated 0.42%.2 And the Nasdaq was the worst performer, falling 1.34%.3 (It should be noted that even after this pullback, the Nasdaq is still up north of 5% on a year-to-date basis).4 Yields ticked up over the course of the week. The 10-year Treasury finished Friday with a yield of 4.28%, up 0.10% from the week prior.5

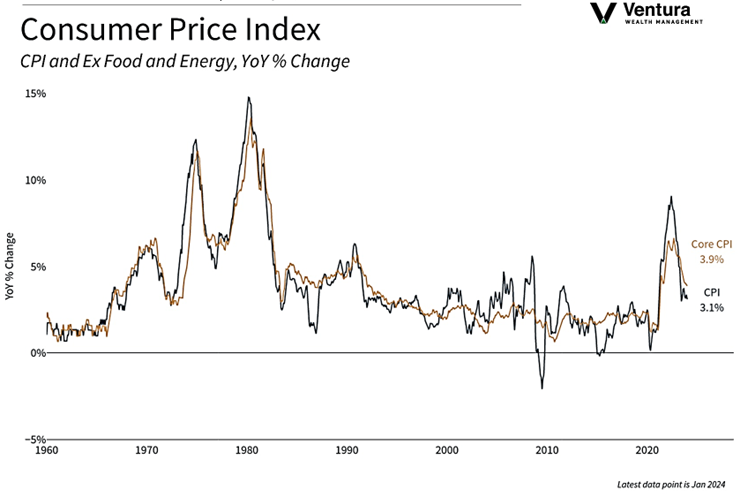

We have been discussing the clear disconnect between the market’s expectations of Federal Reserve policy and the course of action the Federal Reserve is predicting for themselves. Last week’s dual inflation reports, the Consumer Price Index (chart right) and the Producer Price Index, showed that inflation was decelerating at a slower pace than many expected. Combined, these reports tilt toward the policy path that the Federal Reserve has laid out (fewer rate cuts at a slower pace) over the market’s more optimistic path (more rate cuts at a swift pace). Markets have all but ruled out a rate cut for the March meeting, and May is now seen as largely off the table.6 June looks more likely,7 however even this could be too optimistic. Remember, employment figures are still robust and the consumer is hanging in there (even considering last week’s less-than-stellar retail sales report). Economic growth appears healthy. These factors are not disinflationary. The expectation gap between the FOMC and the market may cause further volatility in the weeks ahead.

Chart of the Week

Inflation, as measured by the Consumer Price Index, decelerated from 3.4% in December to 3.1% in January. The reading, however, was above analyst estimates of 2.9%. On a monthly basis, inflation ticked up 0.3%, also higher than policy makers would like.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Labor Statistics, Yahoo! Finance

Statistic of the Week:

CNBC.com, Bankrate.com

Global Perspective:

The Economist

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg

5.MarketWatch.com

6. Barron’s

7. Barron’s