The Profit Margin: February 12, 2024

Statistic of the Week

Americans want to retire early and are confident they will be able to do so. A recent survey found that 74% of respondents are confident that they will be able to retire at age 64 or earlier. The problem? Only 41% have started the process of saving for retirement! The average household believes that they will need about $1.3 million saved to retire successfully.

Global Perspective

Exports in Germany fell 4.6% in December compared to November’s activity. Year-over-year, exports dropped 1.4% and are at the lowest levels since March 2022. There was some positive news: Industrial orders surged 8.9% in the month, the largest monthly increase since June 2020.

Market Moving Events

Monday: Federal Budget

Tuesday: Consumer Price Index

Thursday: Jobless Claims, Retail Sales, Import Prices, Industrial Production

Friday: Housing Starts, Building Permits, Producer Price Index, Consumer Sentiment

Commentary

This market remains in a very good mood. All three domestic equity averages finished the week in positive territory. The Nasdaq and the S&P 500 have both been positive fourteen of the past fifteen weeks.1 The Nasdaq was the week’s leader, rallying 2.31% and had its best weekly close in two years.2 The S&P rose 1.37% and had its first weekly close above 5,000.3 And the DJIA eked out a gain, finishing up 0.04%.4 Yields rose on the week, meaning bond prices fell. The yield on the 10-year Treasury moved up 0.14% to finish Friday at 4.17%.5 Notably, geopolitical tensions and improved growth prospects for the U.S. and China helped push crude oil prices up about 6% on a weekly basis.6

Earnings season has been progressing well for U.S. companies. So far, earnings have been surpassing expectations by about 6.8%.7 Over the past four quarters, on average, earnings have beaten expectations by about 5.7%.8 In general, corporate America remains cautious about its outlook for the year ahead.

There are two significant inflation reports due in the week ahead: the Consumer Price Index (CPI) on Tuesday and Producer Price Index (PPI) on Friday. Analysts expect to see the year-over-year CPI rate fall to 2.9% from last month’s reading of 3.4%.9 Low producer inflation has been allowing consumer prices to stabilize. On Thursday, the retail sales report is expected to show consumer activity down 0.1% in January, largely attributed to a slowdown in auto sales.10 Will it be a surprise in one of these figures that finally slows the market down?

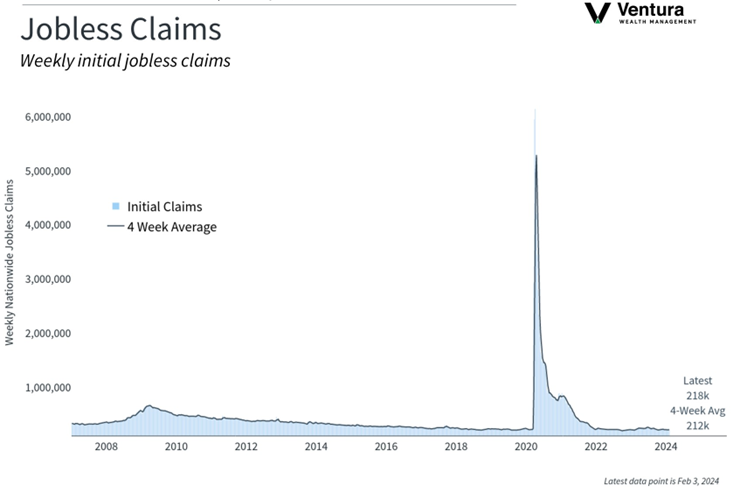

Chart of the Week

Initial jobless claims, as reported by the Bureau of Labor Statistics, remains remarkably low. 218,000 Americans filed for unemployment benefits, down 9,000 from the week prior. Analysts had been expecting claims to total 220,000.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Labor Statistics, MarketWatch.com

Statistic of the Week:

CNBC.com

Global Perspective:

The Economist

Commentary:

1. Investor’s Business Daily

2.Bloomberg

3.Bloomberg

4.Bloomberg

5.MarketWatch.com

6.Zacks.com

7. Barron’s

8. Barron’s

9.MarketWatch.com

10. Investor’s Business Daily