The Profit Margin: December 9, 2024

Statistic of the Week

Feel like your property taxes have been increasing at a significant rate? You’re not alone. Over the past five years, property taxes have risen in almost every major U.S. metro area. Property taxes in the South have seen the largest increases. While Indianapolis takes the top spot with a 67% increase over the period, every other slot in the top ten is filled by a Southern city, predominantly located in Florida (Jacksonville, Tampa, Miami, Ft. Lauderdale, Orlando) and Texas (Ft. Worth, San Antonio, Dallas).

Global Perspective

If economic activity around Thanksgiving is an indicator, the U.S. economy is doing just fine. A record number of travelers moved through American airports for the Thanksgiving holiday. The Transportation Security Administration screened 3.1 million people on December 1 alone, the busiest day of travel in American airports. It was also reported that a record 126 million shoppers visited brick-and-mortar stores over the holiday weekend, up by about 5 million from 2023.

Market Moving Events

Wednesday: CPI

Thursday: Initial Jobless Claims, PPI

Friday: Import Prices

Commentary

Each of the major U.S. equity indexes hit record highs last week.1 Nasdaq was the leader.2 Nasdaq jumped 3.34%.3 The S&P 500 rose 0.96%.4 And the DJIA retreated slightly, falling 0.60% on the week.5 Fixed income markets were quiet. The yield on the 10-year Treasury fell 0.01% to close Friday at 4.17%.6 Over the past month, long-term interest rates have drifted lower. The yield on the ten-year Treasury note fell by 0.14%.7

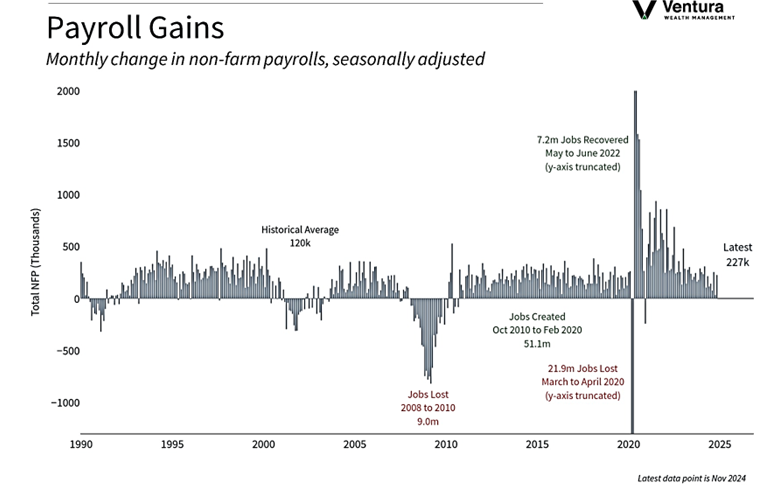

The economy is doing well. The Atlanta Federal Reserve Bank is projecting a 3.2% real GDP growth rate in Q4. The Bureau of Labor Statistics (BLS) reported that in November non-farm payrolls increased by 227,000 (chart right). The BLS revised upward the jobs numbers for September and October. Employment trended up in health care, leisure and hospitality, government and social assistance. Retail trade lost jobs. On the negative side, the unemployment rate increased from 4.1% in October to 4.2% in November.8 One year ago, the unemployment rate was 3.7%.9

Last week, the focus was on jobs. This week the focus will be on inflation. We will get reports on the consumer price index (CPI) and the producer price index (PPI). Barring any big surprise, the markets expect the Federal Open Market Committee (FOMC) to reduce the target interest rate by 0.25% at the December 17-18 meeting. Market sentiment is beginning to look frothy. (Not Frosty – he’s a snowman). Geopolitical events (such as the French no confidence vote and the attempted imposition of martial law in South Korea) continue to be a potential spoiler.

Chart of the Week

The U.S. economy added 227,000 jobs in the month of November according the Bureau of Labor Statistics. The figure slightly exceeded analyst estimates of 220,000.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, The Conference Board

Statistic of the Week:

The New York Times

Global Perspective:

The Economist

Commentary:

1. Investor’s Business Daily

2. Investor’s Business Daily

3. Bloomberg

4. Bloomberg

5. Bloomberg

6. MarketWatch.com

7. MarketWatch.com

8. Bureau of Labor Statistics

9. Bureau of Labor Statistics