The Profit Margin: December 4, 2023

Statistic of the Week

Chip manufacturer Nvidia has been in the news quite a bit the past few years. Its reported earnings last week were exceptional. In their quarterly report, it was noted that about 15%, or $2.7 billion, of the company’s revenue came from Singapore alone. There was a drastic 404.1% surge in revenue from the tiny country year over year. The growth rate of sales to Singapore outpaced Nvidia’s total revenue growth rate of 205.5%. Singapore only trailed the U.S., Taiwan, and China (including Hong Kong) in sales rank.

Global Perspective

Someone started early on their holiday shopping. At Sotheby’s in London, a bottle of Macallan Adami 1926 Scotch Whiskey sold for a record amount – 2.2 million pounds or about $2.7 million. The auction house noted that the sale broke the previous record for a bottle of wine or spirits, which was held by another bottle from the same cask in 2019.

Market Moving Events

Monday: Factory Orders

Tuesday: ISM Services

Wednesday: Trade Deficit

Thursday: Jobless Claims, Consumer Credit

Friday: Nonfarm Payrolls

Commentary

In public remarks last week, Fed Chair Powell said, it is “premature to conclude with confidence that we have achieved a sufficiently restrictive stance.”1 The market disagrees with the Chairman Powell. The Fed Funds range of 5.25%-5.50% represents a 22-year high,2 yet the futures markets are now pricing in rate cuts as early as March.3 Are investors too optimistic about the trajectory of FOMC policy? In November, financial conditions eased at the fastest pace in 40 years.4 Investors clearly believe that the end of the tightening cycle is behind us, and that cuts are not too far in the distance. The Fed is likely concerned that the markets are getting ahead of themselves.

Adding to a string of low inflation prints, the PCE index for October showed no monthly change, a year-over-year rate rise of 3.2%, and when the figures from the last six months are annualized, inflation is running at a rate of 2.5%.5 Third quarter earnings have been strong. Net income is up 4.1% year-over-year and earnings per share is up 7.1%.6 That’s a far cry from the -20% decline forecast by some of Wall Street’s largest firms. (Projections for 2024 EPS growth are around 11%).7 These figures contributed to a significant rally across asset classes in November. The Nasdaq, S&P, and DJIA rose 10.7%, 8.9% and 8.8%,8 respectively. The S&P 500 had its highest close since March of 2022. And, the bond market posted its best monthly performance since the 1980’s.9 Some cooling would not be unimaginable after such a great month. But a continuation into a Santa Claus rally should not be ruled out.

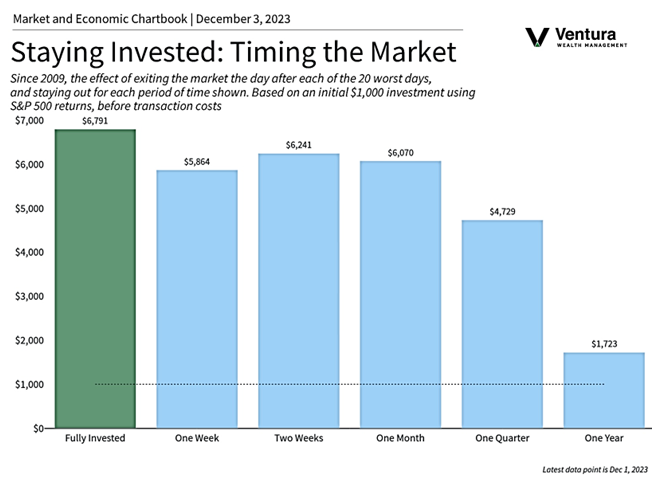

Chart of the Week

November was a great month for investors. It followed three miserable months for investors. This chart underscores the importance of staying invested through difficult periods and the impact that “panic selling” can have on portfolios. More importantly: your net worth.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

The Conference Board

Statistic of the Week:

CNBC.com

Global Perspective: Forbes

Commentary:

1. Investor’s Business Daily

2.MarketWatch.com

3.CNBC.com

4.MarketWatch.com

5. Investor’s Business Daily

6. Barron’s

7. Barron’s

8. Investor’s Business Daily

9. MarketWatch.com