The Profit Margin: December 27, 2022

Statistic of the Week

As part of the omnibus appropriations bill, Secure 2.0 was passed, bringing changes to retirement plans and creating savings incentives. The bill, if signed by the President, will raise the RMD age for IRA distributions to 73 in 2023 and 75 in 2033. It will also create larger “catch up” contribution amounts for 401(k) savers and allow emergency access to retirement accounts. More to follow in next quarter’s Financial Advocate.

Global Perspective

The globe is watching China peel back its zero Covid policies with great skepticism. While the central government claims that there have been only eight deaths since the policy reversal, it appears that hospitals and crematoriums are operating beyond capacity. The Chinese updated the way in which they record Covid deaths in a manner the W.H.O. believes “very much” underestimate the death toll.

Market Moving Events

Monday: US Markets Closed

Tuesday: FHFA Home Price Index

Wednesday: Pending Home Sales

Thursday: Jobless Claims

Commentary

Staying true to this year’s theme, markets were turbulent as we led up to the period where talk of a “Santa Claus Rally” echos around Wall Street. The major averages finished the week mixed, but off their lows. The DJIA was the week’s best performer, finishing up 0.86%.1 The S&P 500 dipped 0.20%.2 And the Nasdaq fared the worst, retreating 1.94%.3 There was a notable uptick in fixed income yields last week. The yield on the 10-year Treasury rose 0.27% to finish Friday at 3.75%.4

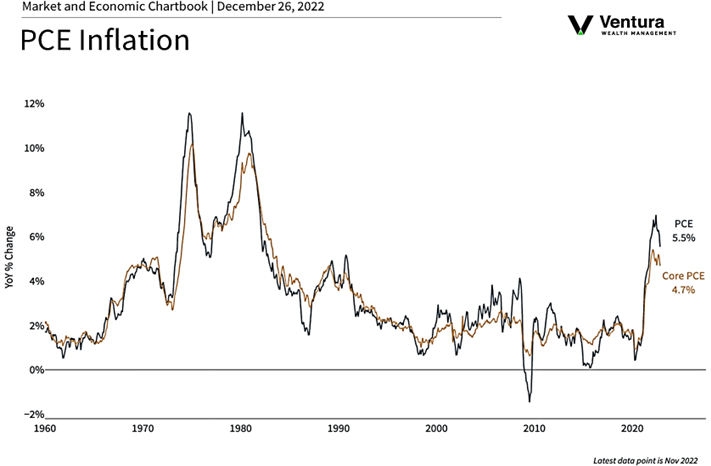

Just as market action was mixed, so too were economic reports. We had good news on inflation (chart right), consumer sentiment, jobless claims, and third quarter GDP (revised higher, again). And then we had negative reports for durable goods orders and the Conference Board’s Index of Leading Economic Indicators. (The LEI is pointing to recession sometime in 2023). Stoking fears that the globe’s central banks are going to spur that recession along, the Bank of Japan implemented a change in policy that added to the week’s volatility.5 But… investors received pretty good earnings reports from two bellwethers, Nike and FedEx.6 We are likely to head into 2023 with the same issue as 2022: crosscurrents. The economy so far is strong enough to stay out of recession, but not strong enough to get investors excited about the future. We expect the last trading week of the year to be volatile on thin trading volumes and a light news schedule. Here’s to a better 2023.

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week: Clearnomics, Barron’s

Statistic of the Week:

CNBC.com

Global Perspective:

Investor’s Business Daily

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg

5.Investor’s Business Daily

6. Investor’s Business Daily