The Profit Margin: December 19, 2022

Statistic of the Week

Americans have been embarking on “revenge travel” and “revenge shopping” this holiday season. And, the strong dollar has helped American tourists descend on Europe. On Black Friday, American spending at European luxury boutiques was up 40% from 2019. In the same luxury boutiques, the average purchase by American tourists was $1,313.

Global Perspective

As China scales back its “Covid Zero” policies, there has been an explosion of cases in the country. Beijing has had a severe uptick, causing the capital to “look like a ghost town.” Assuming that the Chinese government does not reinstate mitigation measures, a model by The Economist suggests that approximately 1.5 million Chinese could die in the outbreak.

Market Moving Events

Monday: NAHB Home Builders Index

Tuesday: Building Permits, Housing Starts

Wednesday: Consumer Confidence, Existing Home Sales

Thursday: Jobless Claims, GDP Revision, Leading Indicators

Friday: PCE Price Index, Durable Goods Orders, Consumer Sentiment, New Home Sales

Commentary

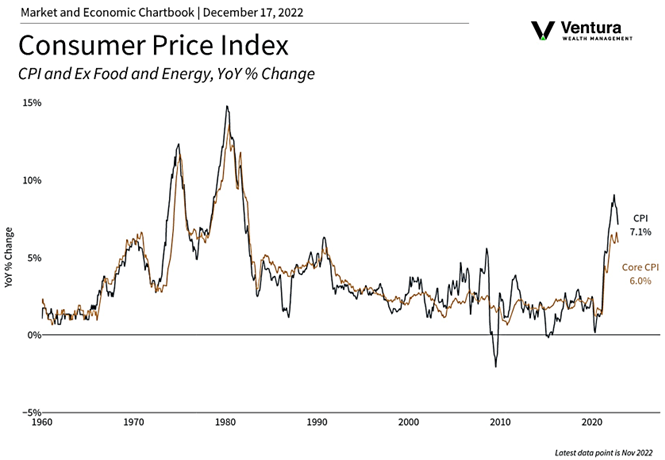

Upside and downside volatility were felt in force last week. Softer-than-expected inflation (chart right) spurred markets higher early in the week; hawkish commentary by Fed Chair Powell a day later caused a strong and quick reversal. All three major domestic equity averages finished lower. The DJIA held up the best, dipping 1.66% on the week.1 The S&P 500 retreated 2.08%.2 And yet again the Nasdaq suffered the worst, down 2.72%.3 The weekly change does not demonstrate the severity of the intra-week move. The S&P 500 retreated about 5% from its high earlier in the week.4 An interesting note – the bond market did not seem to care much about the equity markets’ hissy fit. Bond yields were relatively unchanged. The 10-year Treasury finished Friday with a yield of 3.48%.5

The souring of sentiment resulted from the FOMC meeting announcement and Fed Chair Powell’s press conference. While the Fed increased rates 0.50% (as expected) to a target range of 4.25%-4.50%,6 it was the discussion of the “terminal rate” that captured the market’s attention. The “dot plot” and accompanying forecast now show the terminal Fed Funds rate at 5.1%, up from 4.6%.7 And, the market is now strongly expecting a hike of 0.25% in February.8 The week ahead is heavy on housing reports. However, Friday’s PCE (inflation) reading is the week’s major report. More “soft” inflation data could take the sting out of the Fed’s aggressive stance.

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week: Clearnomics, CNBC.com, Bureau of Labor Statistics

Statistic of the Week:

The Wall Street Journal

Global Perspective:

The Economist, BloombergBusiness

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4. Barron’s

5.Bloomberg

6. Investor’s Business Daily

7. Investor’s Business Daily

8. Investor’s Business Daily