The Profit Margin: December 18, 2023

Statistic of the Week

As of September 2023, survey results found that approximately 60% of Americans are living paycheck to paycheck. Paycheck to paycheck living is not confined to only one income category. 51% of Americans with incomes $100,000 or greater are paycheck to paycheck. “Lifestyle inflation” or “lifestyle creep” is being blamed for higher-income Americans falling into this category.

Global Perspective

Congress passed the $886 billion defense policy bill, which President Biden is expected to sign into law. The bill received broad, bi-partisan support. The 3,100-page piece of legislation covers spending 3% higher than last year. Members of the armed services will be receiving a pay raise of 5.2%. The bill also includes last-minute funding for aid to Ukraine.

Market Moving Events

Tuesday: Housing Starts, Building Permits

Wednesday: Existing Home Sales

Thursday: Jobless Claims, GDP Revision, Leading Economic Indicators

Friday: Durable Goods Orders, Personal Income and Spending, PCE, New Home Sales, Consumer Sentiment

Commentary

Equity markets continued to push higher while yields fell as inflation data continued to move in the right direction and the Federal Reserve signaled that rate cuts were on the table for 2024. All three major domestic averages moved higher. The DJIA led the pack, rallying 2.92%.1 The Nasdaq rose 2.85% and the S&P 500 Rose 2.49%.2 Importantly, the rally appears to be broadening out as both small and mid-cap company performance has improved. In the press conference following the FOMC meeting, Chair Powell noted that “We have done enough,”3 referring to raising rates. He also indicated that the risks at this point in the cycle are remaining too tight for too long.4 The yield on the 10-year Treasury fell 0.32% for the week and finished Friday at 3.91%.5

While many are winding down as we near year-end, this week is packed with economic data releases. Housing market data is peppered in throughout the week. Lower Treasury yields should help the financing side of the housing equation. However, supply remains a major challenge. Leading Economic Indicators on Thursday will be monitored closely. This indicator has been flashing “warning” signs that the economy is on the brink of a recession for over a year. Bears will likely point to continued weakness as a reason to sell. And perhaps most importantly, on Friday the PCE inflation reading will be released. Core is expected to have risen 0.1% in November.6 Additional “soft” inflation data could further spur on the rally.

There will be no “Profit Margin” next week – enjoy the holidays!

Chart of the Week

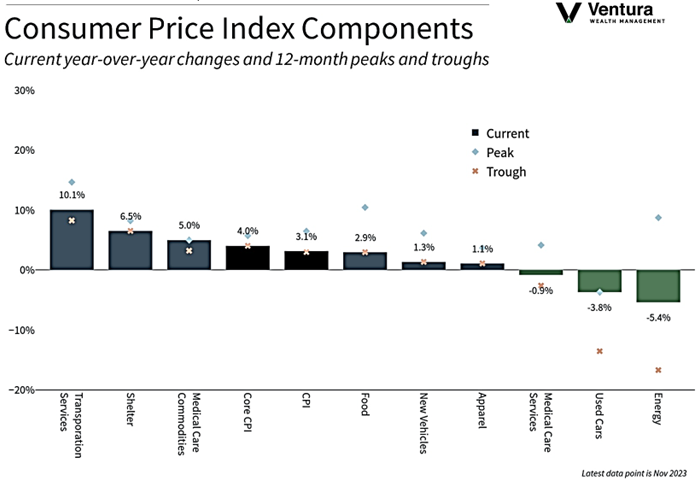

November’s CPI report was interpreted positively by markets. Year-over-year inflation was measured at 3.1%. Declines in energy and used car prices are notable.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Labor Statistics

Statistic of the Week:

CNBC.com

Global Perspective: NBC.com, USA Today

Commentary:

1.Bloomberg

2.Bloomberg

3.Investor’s Business Daily

4.Investor’s Business Daily

5. MarketWatch.com

6. Investor’s Business Daily