The Profit Margin: August 8, 2022

Statistic of the Week

It does not look like the trend of remote or hybrid work is slowing down. In a survey published in the Future Forum’s Pulse Report, 69% of Americans are working remote or hybrid. In a report from Ladders.com, over the next year 25% of all professional jobs earning $100,000 or more will be fully remote.

Global Perspective

Levels of the Rhine River in Germany have fallen to a level that leaves barge transportation perilously near to closing on the waterway. Because of the low water levels, barges cannot be loaded to full capacity, pushing up transportation costs. Some vessels are sailing at 25% capacity. This problem will likely further complicate global supply chain issues.

Market Moving Events

Wednesday: Consumer Price Index, Federal Budget, Wholesale Inventories

Thursday: Jobless Claims, Producer Price Index

Friday: Import Prices, Consumer Sentiment

Commentary

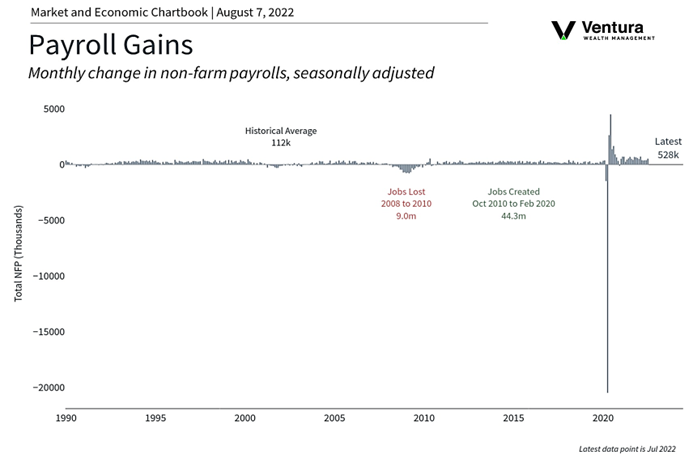

Domestic equity performance was mixed last week as several Federal Reserve governors provided public commentary, earnings season continued, and we received the much-anticipated nonfarm payrolls figure (chart right). The beaten down Nasdaq was the week’s best performer, rallying 2.15%.1 The S&P 500 moved 0.36% higher.2 And the more narrowly focused DJIA retreated slightly, losing 0.13%.3 With a chorus of Fed governors singing the same tune – that policy is more likely to remain restrictive longer and that a “pivot” to a more accommodative stance is not in the cards – yields on Treasuries rose. The 10-year Treasury finished Friday with a yield of 2.84%, up 0.20% from the week prior.4

At this point in the calendar, 71% of the S&P 500 has reported earnings and 77% have beaten analyst expectations.5 Revenue growth is hovering around 13% year over year.6 These are solid figures. Additionally, July’s jobs report provides a backdrop of a very strong labor market. (Unemployment at 3.5% matches a 53-year low).7 Adjusted for inflation, consumer spending is up 1% over the past twelve months.8 Notably, a robust labor market is helping the consumer “hang in there” despite recession fears and high inflation.

Later this week we will receive the critical CPI report, the PPI report, and consumer sentiment readings.

Chart of the Week

Sources

Statistic of the Week:

CNBC.com

Global Perspective:

Reuters

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Haver,

Bureau of Labor Statistics

Commentary: 1.Bloomberg 2.Bloomberg 3.Bloomberg 4.Bloomberg 5. Investor’s Business Daily 6. Barron’s 7. Investor’s Business Daily 8. Investor’s Business Daily