The Profit Margin: August 5, 2024

Statistic of the Week

The steep decline in bond yields last week should translate into some much-needed relief for home buyers. Mortgage rates hit their lowest levels since February. The average 30-year fixed rate moved to 6.73% according to Freddie Mac. A year ago, the average rate was 6.90%. The 15-year fixed rate has fallen to 5.99%.

Global Perspective

Watching the Olympics is fun, but… it is likely translating into lost productivity for American companies. A survey by UKG Workforce Institute found that approximately 12.3 million Americans were planning on watching some events during the workday. Employees sneaking in Olympic viewing during work hours is projected to cost American firms about $2.6 billion in lost productivity.

Market Moving Events

Tuesday: Trade Deficit

Thursday: Jobless Claims

Wednesday: Consumer Credit

Commentary

Call it a “growth scare.” A series of soft economic data points last week kept market volatility elevated, with losses on Friday capping off already weak trading in the equity markets. All three major indices finished the week firmly in the red. The S&P 500 was the best performer, falling 2.06%.1 The DJIA dipped 2.10%.2 And the Nasdaq retreated into correction territory, pulling back 3.35%.3 Pain for equity investors translated into gain for holders of fixed income instruments. Bond yields fell considerably on the week. The 10-year Treasury yield shifted 0.41% lower to finish Friday at 3.79%.4

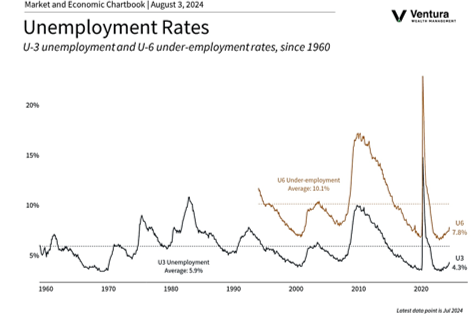

The FOMC meeting announcement on Wednesday was greeted positively by investors. Chair Powell hinted strongly that a rate cut would take place at the September 18 meeting but noted that a double cut (50 basis points) had not been discussed.5 The investment markets, after viewing several weaker-than-expected data points on Thursday and Friday, are betting that a 50 basis point cut is very much on the table.6 On Thursday, initial jobless claims jumped to a 12-month high7 and the ISM Manufacturing Index fell to an 8-month low.8 Then on Friday, the employment report from the BLS showed the economy added only 114,000 jobs in July compared to 179,000 jobs in June. The BLS also reported that the unemployment rate increased to 4.3 percent from 4.1 in June. 9 The increase in the unemployment rate was due in part to a 420,000 increase in the labor force. The week ahead is notably light on economic data. Earnings reports continue. From October of last year equity markets had rallied strongly. Further volatility is expected.

Chart of the Week

There was a notable slowdown in new hires in July and the unemployment rate rose from 4.1% to 4.3%. The current rate sits at a three-year high.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Labor Statistics,

Reuters.com

Statistic of the Week:

Yahoo! Finance

Global Perspective:

MarketWatch.com

Commentary:

1. Bloomberg

2. Bloomberg

3. Bloomberg

4. MarketWatch.com

5. Barron’s

6. Barron’s

7. Investor’s Business Daily

8. Investor’s Business Daily

9. Bureau of Labor Statistics