The Profit Margin: August 29, 2022

Statistic of the Week

The Biden Administration made headlines with its student loan forgiveness program.

$10,000 in federal student loan forgiveness will apply for borrowers making less than

$125,000 per year. That figure increases to $20,000 for Pell Grant recipients. A recent poll

found that 59% of Americans fear that student loan forgiveness will exacerbate the

persistent inflation problem.

Global Perspective

There is no doubt that the war in Ukraine is causing the displacement of millions. More than 11.15 million Ukrainians have left their own country, with an additional 6.64 million displaced within Ukraine. Additionally, more than 3.8 million Russians have left Russia this year – many due to the conflict. For Russia, it is the largest exodus since the collapse of the USSR.

Market Moving Events

Tuesday: Consumer Confidence, Case-Shiller Home Price Index, JOLTS

Wednesday: Chicago Manufacturing PMI

Thursday: Jobless Claims, ISM Manufacturing, Construction Spending

Friday: Nonfarm Payrolls, Factory Orders, Unemployment Rate

Commentary

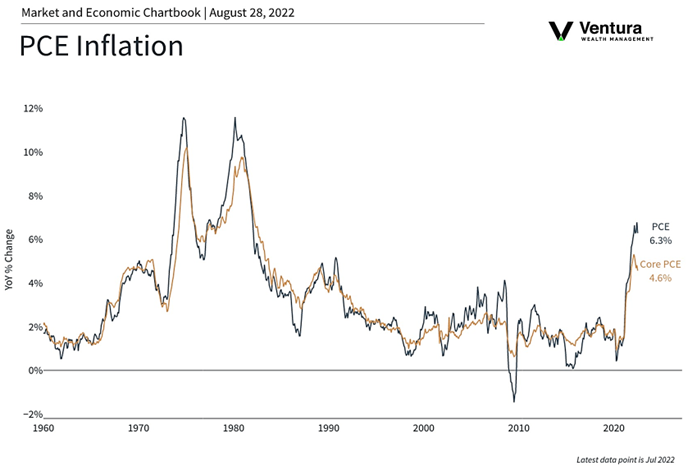

It was a turbulent week on Wall Street before Fed Chair Powell spoke at the Fed’s annual Jackson Hole Economic Symposium. His comments sparked a greater uptick in volatility and coincident selloff in risk assets. On the week, the S&P 500 fared the best of the three major indices, dropping 4.04%.1 The DJIA retreated 4.22%, while the Nasdaq fell 4.44%.2 In these weekly declines, roughly 3.5% came from Friday’s action. Fixed income investors did not benefit from the selloff in equities as yields rose on the week. The 10-year Treasury finished Friday with a yield of 3.04%.3

Chair Powell came to the podium with a clear message: the Federal Reserve is on a mission to quelch inflation. Markets were expecting to hear this to some degree; a 0.75% interest rate hike is probable for September. What frightened investors is not so much the magnitude of Fed policy, but the implied duration. Powell said, “Restoring price stability will likely require maintaining a restrictive policy stance for some time.”4 This stature may “bring some pain to households and businesses.”5 The goal is not to repeat the failures of the 1970’s.

Investors and the Federal Reserve will likely remain focused on both inflation and employment. Friday’s PCE inflation figure was a positive note on a dreary day. The week ahead will focus on employment with a new jobs report format out of ADP,6 nonfarm payrolls, JOLTS, the unemployment rate, and jobless claims. Volatility will likely persist.

Chart of the Week

Sources

Statistic of the Week:

TheHill.com, CNBC.com

Global Perspective:

CNN.com, Forbes.com

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Haver,

Bureau of Economic Analysis

Commentary: 1.Bloomberg 2.Bloomberg 3.Bloomberg 4. Investor’s Business Daily 5. Investor’s Business Daily 6. Barron’s